5% Mortgages are back.

5% Mortgages are back.

30-year notes have dipped from 190 in 2020 to 145 this morning and that's down 23.6% in two years – horrific losses for the long-term bond market but what sort of idiot was lending the Government money for 30 years at 1.25% anyway? Now it's 2.666% but this is just the start of the Fed's tightening cycle with another 2% (at least) to go in the next 8 months and already 30-year mortages are being priced over 5%, up from 3.5% in 2020, with lows all the way down at 2.5% briefly.

And look how fast rates have climbed in 2022 – this is why home-buying has ground to a halt. A $500,000 home with a $400,000 mortgage (assuming you have $100,000 to put down) cost you $1,686 a month at 3% in the Fall but now, in April, it's costing you $2,147 a month – an increase of $461/month (27.3%) in just one quarter. Even if you have a $100,000 job and just got a 10% raise, the take-home is only going to be +$6,000/yr to pay the extra $5,532 so you'd better hope nothing else went up in price or you'll have to cut back on other things.

Of course, once upon a time, we used to EXPECT 10% raises every year so we would stretch on a Mortgage because, after a few 10% raises, $2,147/month would seem like a fantastic bargain – especially if your home's value were also rising 10%, as the leverage you have on your home would make you a winner. That's how our parents were able to retire pretty comfortably but that Social Contract collapsed in 2008.

Of course, once upon a time, we used to EXPECT 10% raises every year so we would stretch on a Mortgage because, after a few 10% raises, $2,147/month would seem like a fantastic bargain – especially if your home's value were also rising 10%, as the leverage you have on your home would make you a winner. That's how our parents were able to retire pretty comfortably but that Social Contract collapsed in 2008.

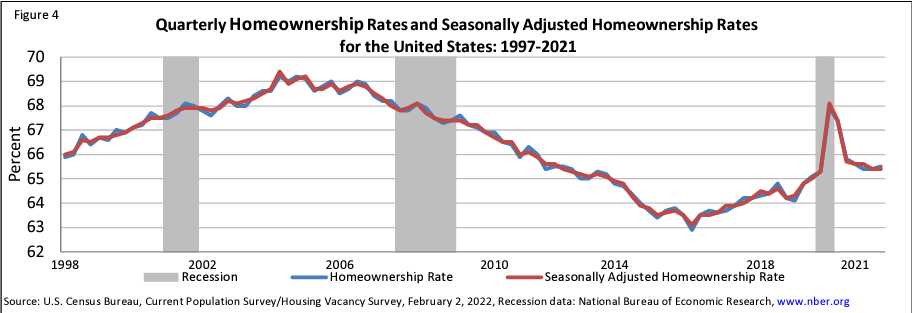

Close to 70% of the people in America owned homes in 2004 but that number has dropped to 65.5% now and that is putting upward pressure on the rental market, where prices have climbed 20% in the past 12 months. In large part, that's due to a surge of people losing their homes during Covid as ownership plunged from 68 to where we are now. You would think 5% is unaffordable but it's only sticker shock as we've gotten…