Etsy currently trades at $56.75 per share and has shown little upside over the past six months, posting a middling return of 2.5%. This is close to the S&P 500’s 7.3% gain during that period.

Is now the time to buy Etsy, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.We're sitting this one out for now. Here are three reasons why there are better opportunities than ETSY and a stock we'd rather own.

Why Is Etsy Not Exciting?

Founded by a struggling amateur furniture maker Robert Kalin and his two friends, Etsy (NASDAQ:ETSY) is one of the world’s largest online marketplaces, focusing on handmade or vintage items.

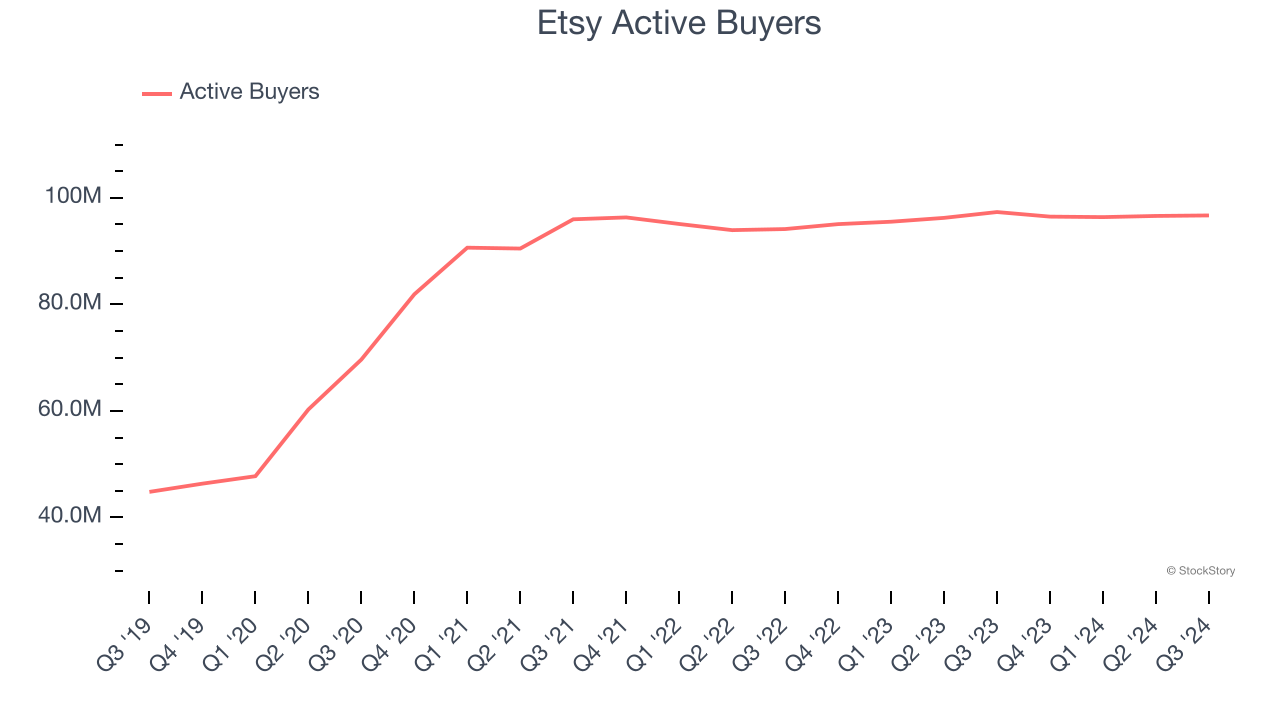

1. Active Buyers Hit a Plateau

As an online marketplace, Etsy generates revenue growth by increasing both the number of users on its platform and the average order size in dollars.

Etsy struggled to engage its active buyers over the last two years as they have been flat at 96.71 million. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If Etsy wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

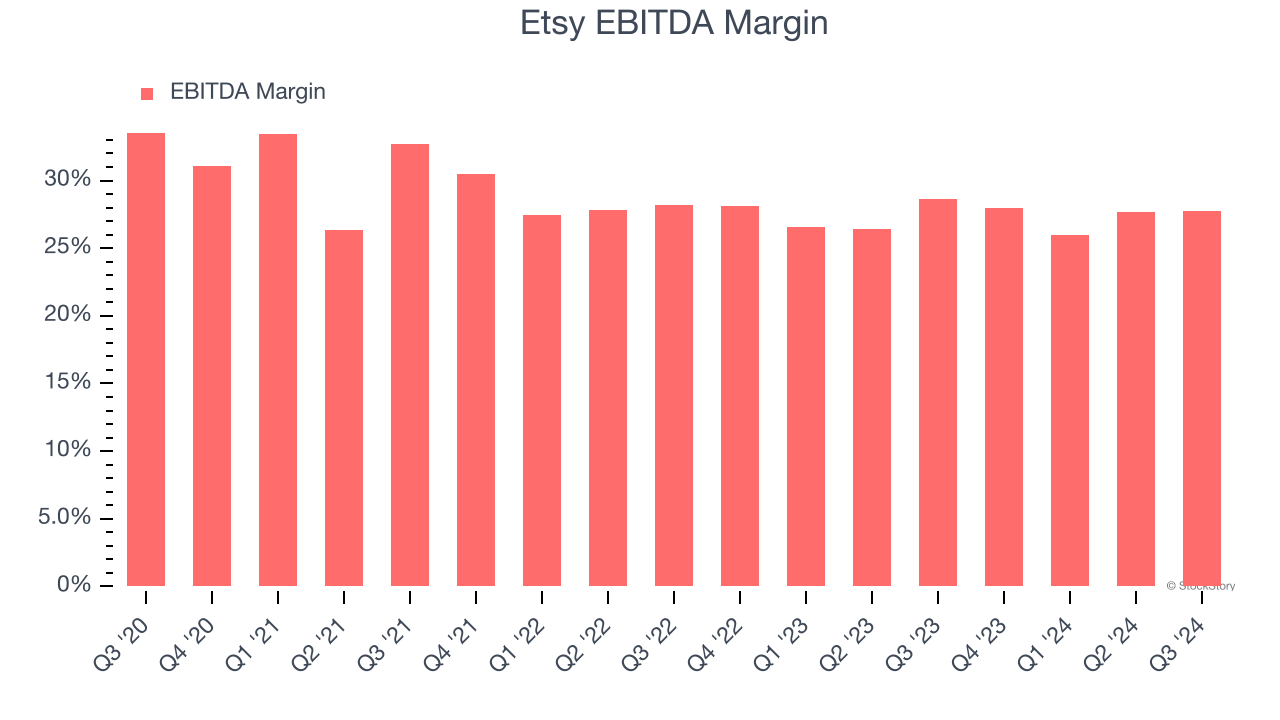

2. EBITDA Margin Falling

Investors frequently analyze operating income to understand a business’s core profitability. Similar to operating income, EBITDA is a common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of profit potential.

Analyzing the trend in its profitability, Etsy’s EBITDA margin decreased by 3.6 percentage points over the last few years. Even though its historical margin is high, shareholders will want to see Etsy become more profitable in the future. Its EBITDA margin for the trailing 12 months was 27.4%.

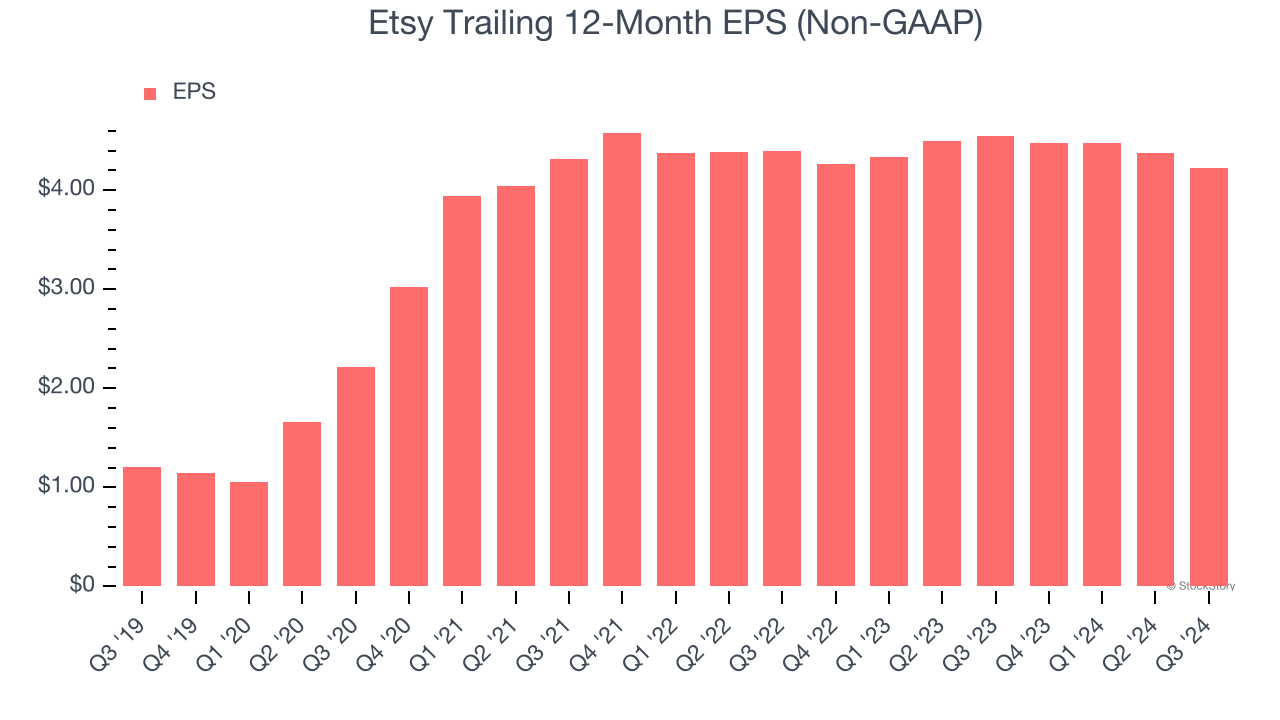

3. EPS Growth Has Stalled

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Etsy’s flat EPS over the last three years was below its 7.9% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Etsy isn’t a terrible business, but it isn’t one of our picks. That said, the stock currently trades at 9.4× forward EV-to-EBITDA (or $56.75 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward FTAI Aviation, an aerospace company benefiting from Boeing and Airbus’s struggles.

Stocks We Would Buy Instead of Etsy

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.