Egg company Cal-Maine Foods (NASDAQ:CALM) beat Wall Street’s revenue expectations in Q4 CY2024, with sales up 82.5% year on year to $954.7 million. Its GAAP profit of $4.47 per share was 21.5% above analysts’ consensus estimates.

Is now the time to buy Cal-Maine? Find out by accessing our full research report, it’s free.

Cal-Maine (CALM) Q4 CY2024 Highlights:

- Revenue: $954.7 million vs analyst estimates of $751.5 million (82.5% year-on-year growth, 27% beat)

- Adjusted EPS: $4.47 vs analyst estimates of $3.68 (21.5% beat)

- Operating Margin: 29.1%, up from 6.5% in the same quarter last year

- Market Capitalization: $5.14 billion

Sherman Miller, president and chief executive officer of Cal-Maine Foods, stated, “Cal-Maine Foods delivered a very strong financial and operating performance in the second quarter of fiscal 2025. Robust demand for shell eggs resulted in a significant increase in dozens sold for the quarter, which included the seasonal boost leading up to the Thanksgiving holiday and sales from our latest acquisition completed in June. Our results also reflect higher market prices, which have continued to rise this fiscal year as supply levels of shell eggs have been restricted due to recent outbreaks of highly pathogenic avian influenza (“HPAI”).

Company Overview

Known for brands such as Egg-Land’s Best and Land O’ Lakes, Cal-Maine (NASDAQ:CALM) produces, packages, and distributes eggs.

Perishable Food

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

Sales Growth

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

Cal-Maine carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the other hand, it can still flex high growth rates because it’s working from a smaller revenue base.

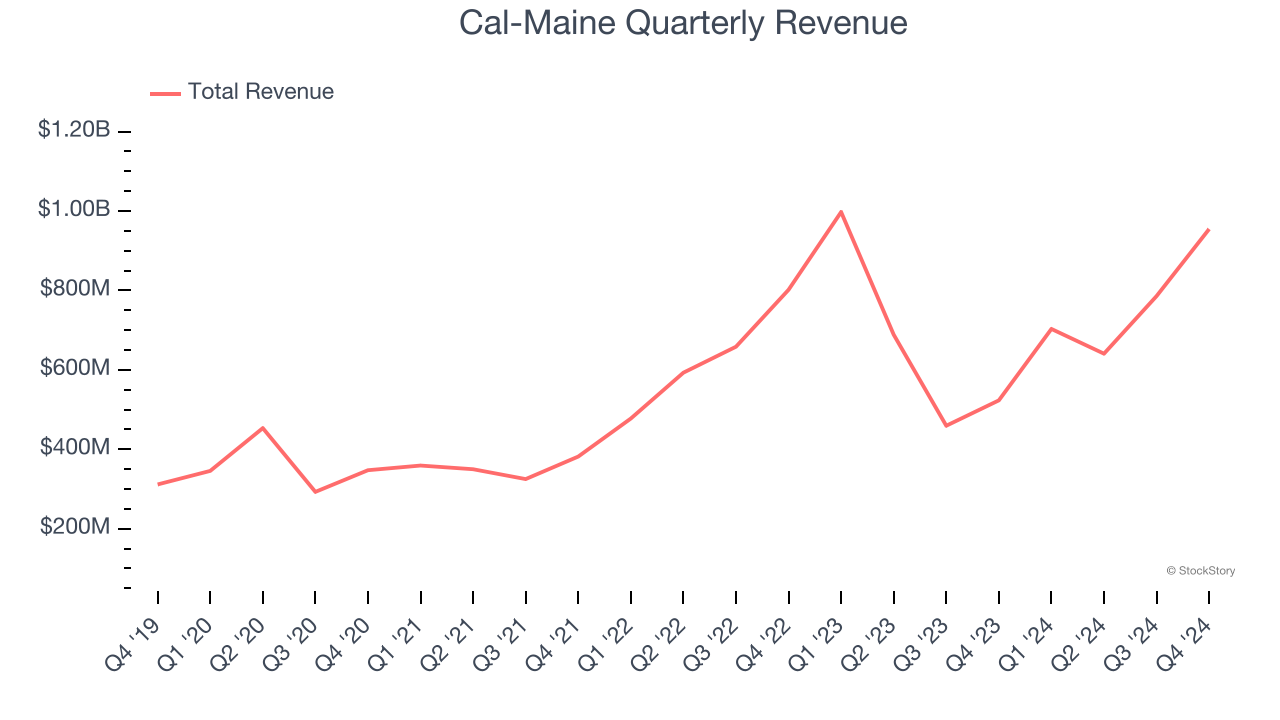

As you can see below, Cal-Maine’s sales grew at an exceptional 29.6% compounded annual growth rate over the last three years. This shows it had good demand, a useful starting point for our analysis.

This quarter, Cal-Maine reported magnificent year-on-year revenue growth of 82.5%, and its $954.7 million of revenue beat Wall Street’s estimates by 27%.

Looking ahead, sell-side analysts expect revenue to decline by 25% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and implies its products will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

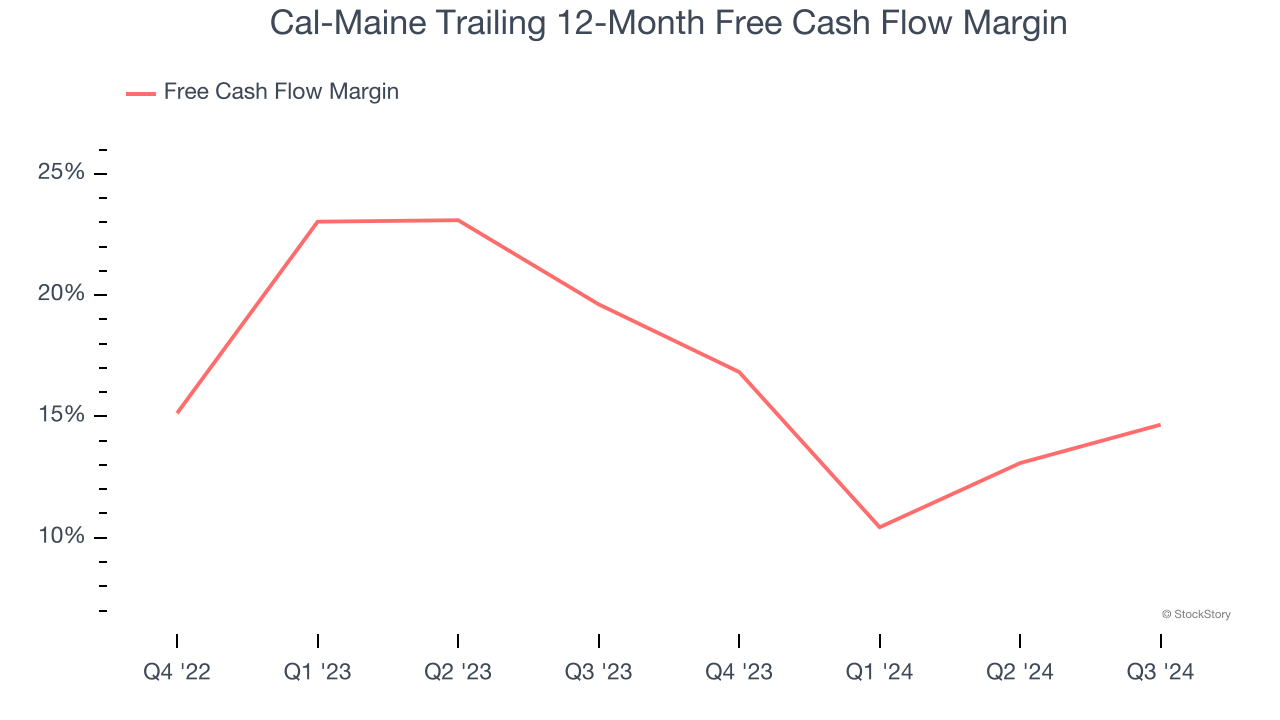

Cal-Maine has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the consumer staples sector, averaging 17.2% over the last two years.

Key Takeaways from Cal-Maine’s Q4 Results

We were impressed by how significantly Cal-Maine blew past analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 3.6% to $107.42 immediately after reporting.

Cal-Maine had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.