Construction Partners has been on fire lately. In the past six months alone, the company’s stock price has rocketed 54.4%, reaching $88.35 per share. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Following the strength, is ROAD a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Does Construction Partners Spark Debate?

Founded in 2001, Construction Partners (NASDAQ:ROAD) is a civil infrastructure company that builds and maintains roads, highways, and other infrastructure projects.

Two Things to Like:

1. Strong Organic Growth: Core Business Firing on All Cylinders

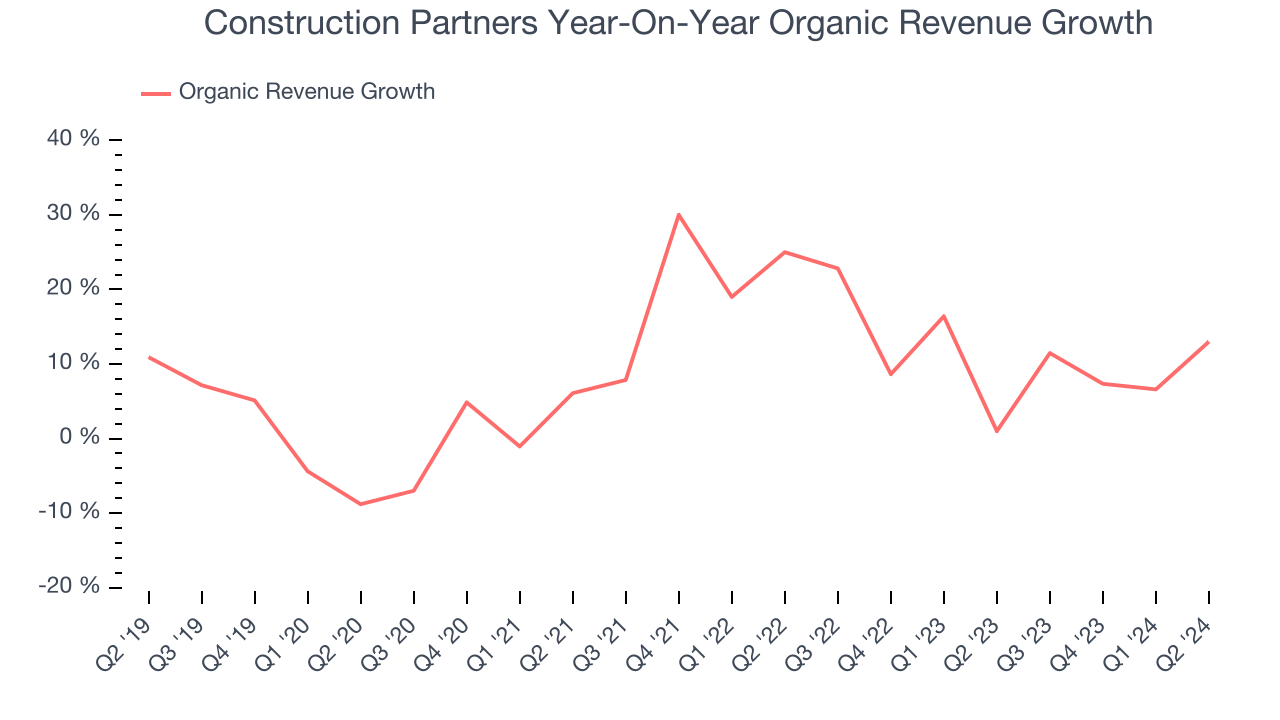

We can better understand construction and engineering companies by analyzing their organic revenue. This metric gives visibility into Construction Partners’s core business as it excludes the impacts of foreign currency fluctuations and one-time events such as mergers, acquisitions, and divestitures.

Over the last two years, Construction Partners’s organic revenue averaged 10.9% year-on-year growth. This was one of the best results in the industrials sector and shows demand is soaring for its products.

2. EPS Increasing Steadily

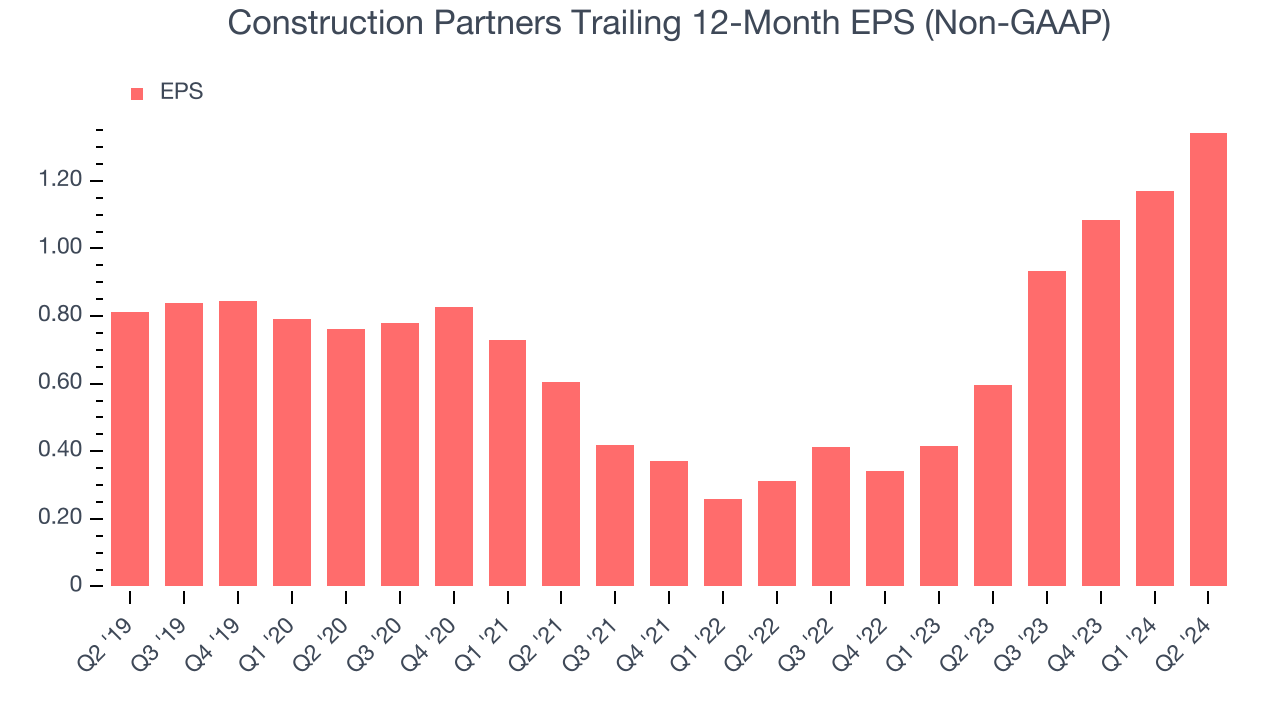

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth was profitable.

Construction Partners’s EPS grew at a solid 10.6% compounded annual growth rate over the last five years. This performance was better than most industrials businesses.

One Reason to be Careful:

Low Gross Margin: Weak Structural Profitability

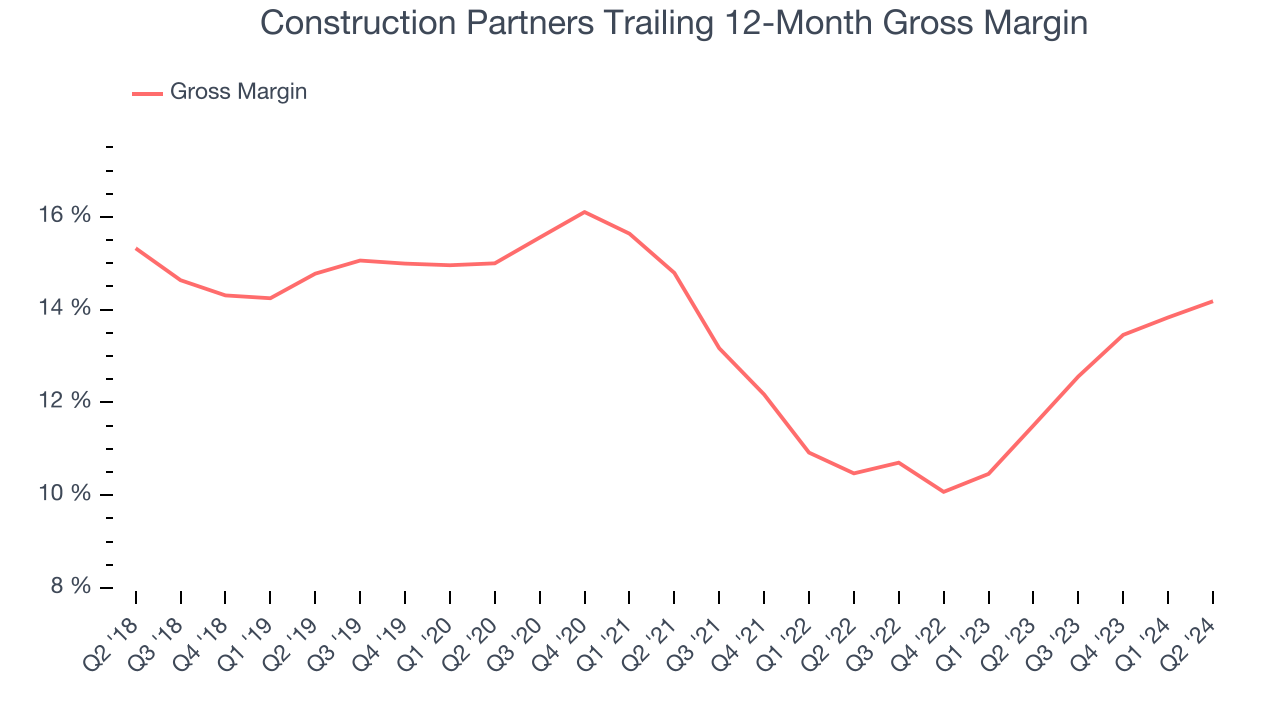

For industrials businesses, cost of sales is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics in the short term and a company’s purchasing power and scale over the long term.

Construction Partners has poor unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 13% gross margin over the last five years. That means Construction Partners paid its suppliers a lot of money ($87.00 for every $100 in revenue) to run its business.

Final Judgment

Construction Partners’s positive characteristics outweigh the negatives, and after the recent rally, the stock trades at 54.8x forward price-to-earnings (or $88.35 per share). Is now a good time to buy despite the frothiness? See for yourself in our full research report, it’s free.

Stocks We Like More Than Construction Partners

With rates dropping, inflation stabilizing, and the elections in the rear-view mirror, all signals point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like United Rentals (+550% five-year return). Find your next big winner with StockStory today for free.