Golf entertainment and gear company Topgolf Callaway (NYSE:MODG) reported revenue ahead of Wall Street’s expectations in Q3 CY2024, but sales fell 2.7% year on year to $1.01 billion. On the other hand, next quarter’s revenue guidance of $885 million was less impressive, coming in 4.5% below analysts’ estimates. Its non-GAAP profit of $0.02 per share was also 112% above analysts’ consensus estimates.

Is now the time to buy Topgolf Callaway? Find out by accessing our full research report, it’s free.

Topgolf Callaway (MODG) Q3 CY2024 Highlights:

- Revenue: $1.01 billion vs analyst estimates of $981.8 million (3.2% beat)

- Adjusted EPS: $0.02 vs analyst estimates of -$0.16 ($0.18 beat)

- EBITDA: $119.8 million vs analyst estimates of $100.6 million (19.1% beat)

- Revenue Guidance for Q4 CY2024 is $885 million at the midpoint, below analyst estimates of $926.8 million

- Management lowered its full-year Adjusted EPS guidance to $0.11 at the midpoint, a 34.4% decrease

- EBITDA guidance for the full year is $565 million at the midpoint, below analyst estimates of $573.6 million

- Gross Margin (GAAP): 30.6%, down from 33.2% in the same quarter last year

- Operating Margin: 3.3%, down from 7.1% in the same quarter last year

- EBITDA Margin: 11.8%, down from 15.7% in the same quarter last year

- Free Cash Flow Margin: 10.8%, down from 11.9% in the same quarter last year

- Market Capitalization: $1.78 billion

"We are pleased to announce results that exceeded our expectations for Q3 amid a challenging macroeconomic backdrop," commented Chip Brewer, President and Chief Executive Officer of Topgolf Callaway Brands.

Company Overview

Formed between the merger of Callaway and Topgolf, Topgolf Callaway (NYSE:MODG) sells golf equipment and operates technology-driven golf entertainment venues.

Leisure Facilities

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

Sales Growth

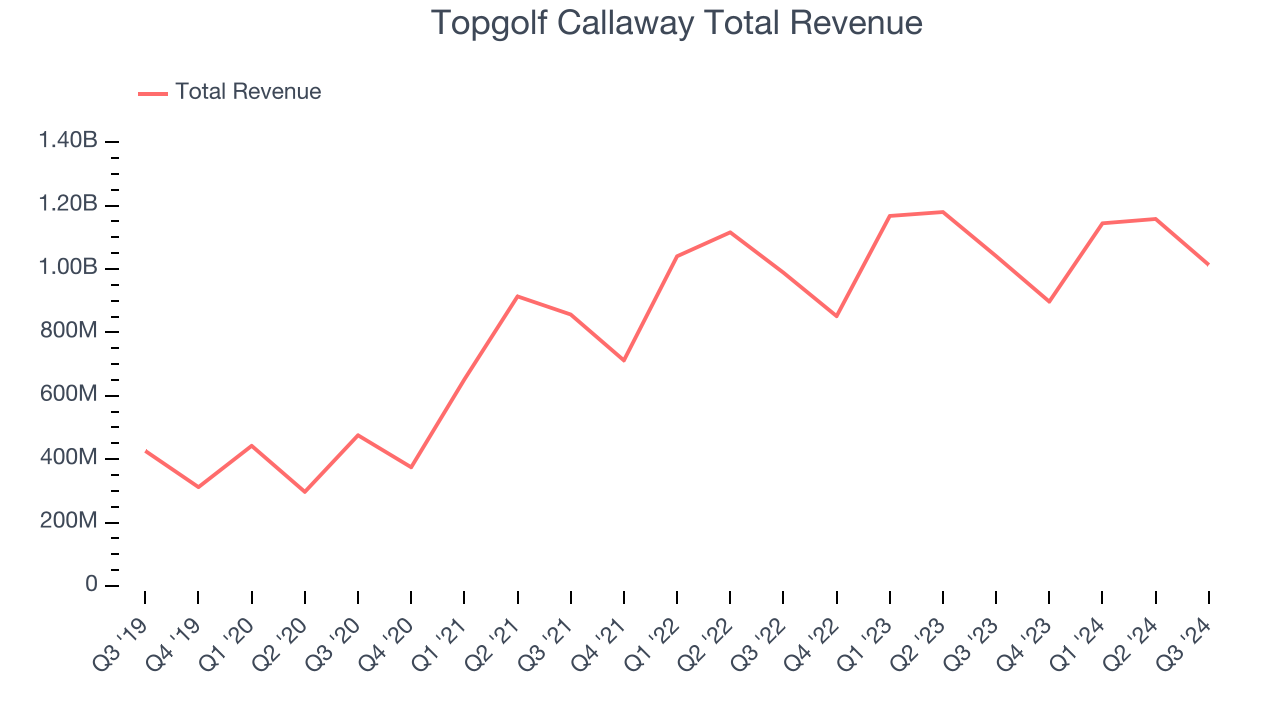

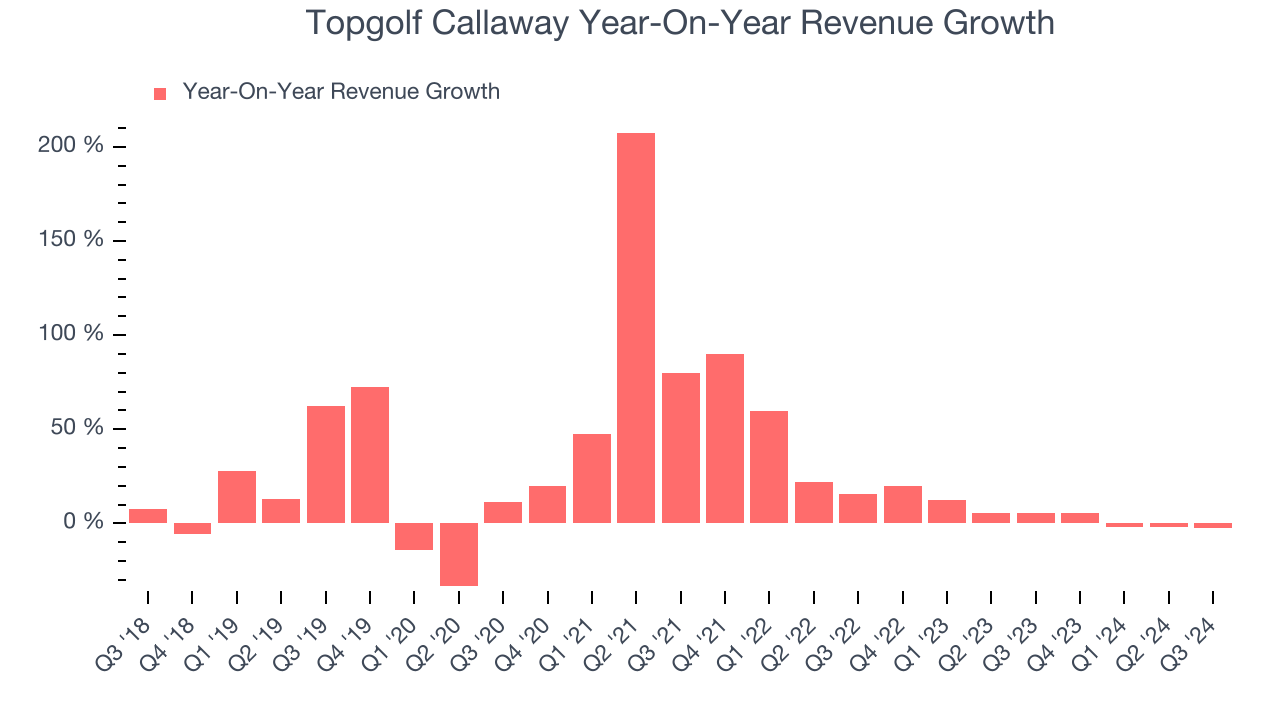

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Topgolf Callaway’s 21.8% annualized revenue growth over the last five years was impressive. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or emerging trend. Topgolf Callaway’s recent history shows its demand slowed significantly as its annualized revenue growth of 4.5% over the last two years is well below its five-year trend. Note that COVID hurt Topgolf Callaway’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

This quarter, Topgolf Callaway’s revenue fell 2.7% year on year to $1.01 billion but beat Wall Street’s estimates by 3.2%. Company management is currently guiding for a 1.3% year-on-year decline next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.2% over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and indicates its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

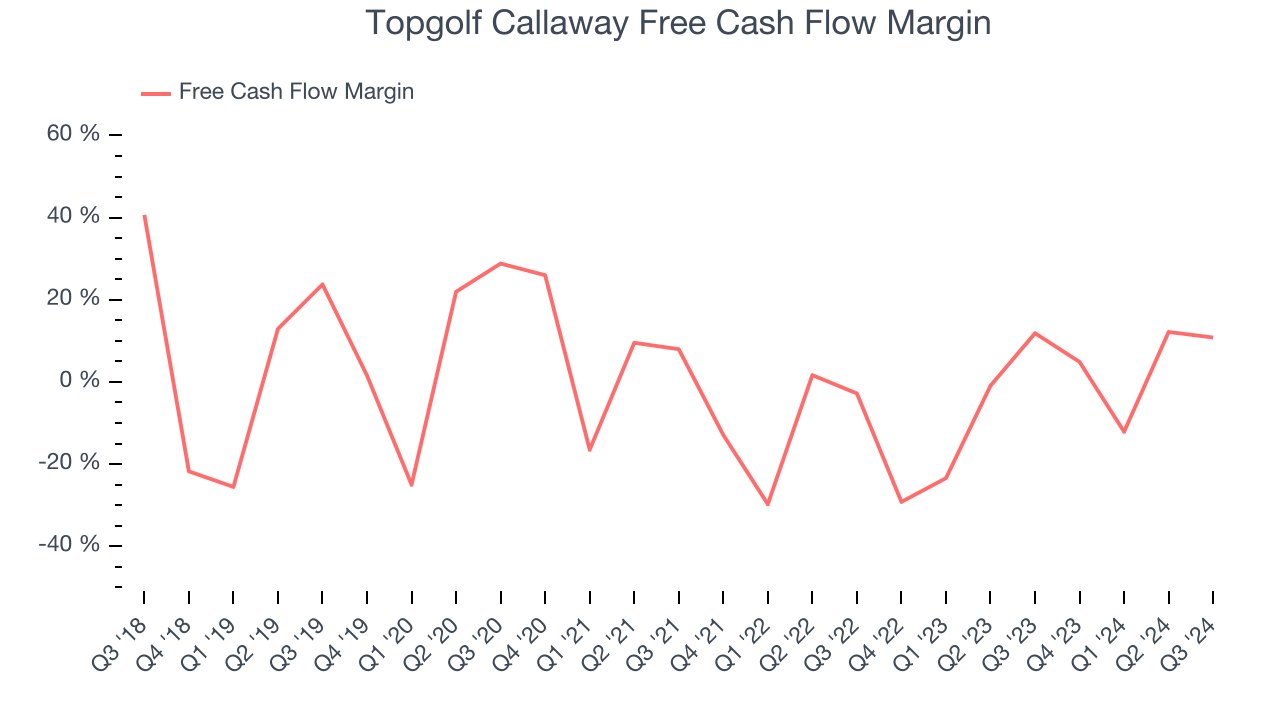

While Topgolf Callaway posted positive free cash flow this quarter, the broader story hasn’t been so clean. Over the last two years, Topgolf Callaway’s demanding reinvestments to stay relevant have drained its resources. Its free cash flow margin averaged negative 3%, meaning it lit $3.01 of cash on fire for every $100 in revenue.

Topgolf Callaway’s free cash flow clocked in at $109.5 million in Q3, equivalent to a 10.8% margin. The company’s cash profitability regressed as it was 1 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t put too much weight on this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends trump temporary fluctuations.

Over the next year, analysts predict Topgolf Callaway’s cash conversion will slightly fall. Their consensus estimates imply its free cash flow margin of 3.7% for the last 12 months will decrease to 2%.

Key Takeaways from Topgolf Callaway’s Q3 Results

We were impressed by how significantly Topgolf Callaway blew past analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates. On the other hand, its EBITDA forecast for next quarter missed and its revenue guidance for next quarter came in slightly below Wall Street’s estimates. Zooming out, we think this was a mixed but decent quarter. The stock traded up 4.4% to $9.86 immediately following the results.

Should you buy the stock or not? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.