Aerospace and defense company Leonardo DRS (NASDAQ:DRS) reported Q3 CY2024 results topping the market’s revenue expectations, with sales up 15.5% year on year to $812 million. The company’s full-year revenue guidance of $3.18 billion at the midpoint also came in 1.2% above analysts’ estimates. Its GAAP profit of $0.21 per share was also 27.3% above analysts’ consensus estimates.

Is now the time to buy Leonardo DRS? Find out by accessing our full research report, it’s free.

Leonardo DRS (DRS) Q3 CY2024 Highlights:

- Revenue: $812 million vs analyst estimates of $775.4 million (4.7% beat)

- EPS: $0.21 vs analyst estimates of $0.17 (27.3% beat)

- EBITDA: $100 million vs analyst estimates of $90.56 million (10.4% beat)

- The company lifted its revenue guidance for the full year to $3.18 billion at the midpoint from $3.13 billion, a 1.6% increase

- EBITDA guidance for the full year is $392 million at the midpoint, above analyst estimates of $385.8 million

- Gross Margin (GAAP): 22%, in line with the same quarter last year

- Operating Margin: 9.2%, in line with the same quarter last year

- EBITDA Margin: 12.3%, in line with the same quarter last year

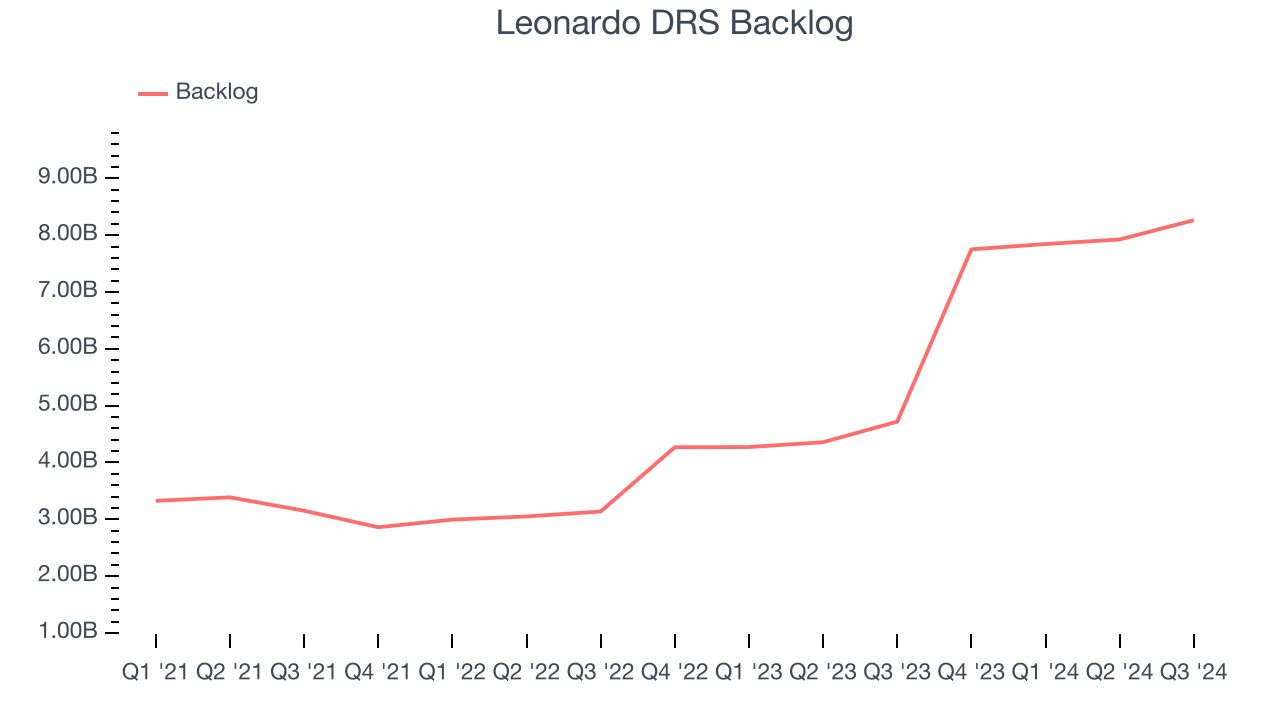

- Backlog: $8.26 billion at quarter end, up 75.1% year on year

- Market Capitalization: $7.49 billion

“We delivered strong third quarter results, highlighted by robust bookings, mid-teens organic revenue growth, increases to all of our key profit metrics and healthy free cash flow generation. Our strategy, execution focus and steadfast commitment to our customers are driving outcomes that continue to exceed our expectations", said Bill Lynn, Chairman and CEO of Leonardo DRS.

Company Overview

Developing submarine detection systems for the U.S. Navy, Leonardo DRS (NASDAQ:DRS) is a provider of defense systems, electronics, and military support services.

Defense Contractors

Defense contractors typically require technical expertise and government clearance. Companies in this sector can also enjoy long-term contracts with government bodies, leading to more predictable revenues. Combined, these factors create high barriers to entry and can lead to limited competition. Lately, geopolitical tensions–whether it be Russia’s invasion of Ukraine or China’s aggression towards Taiwan–highlight the need for defense spending. On the other hand, demand for these products can ebb and flow with defense budgets and even who is president, as different administrations can have vastly different ideas of how to allocate federal funds.

Sales Growth

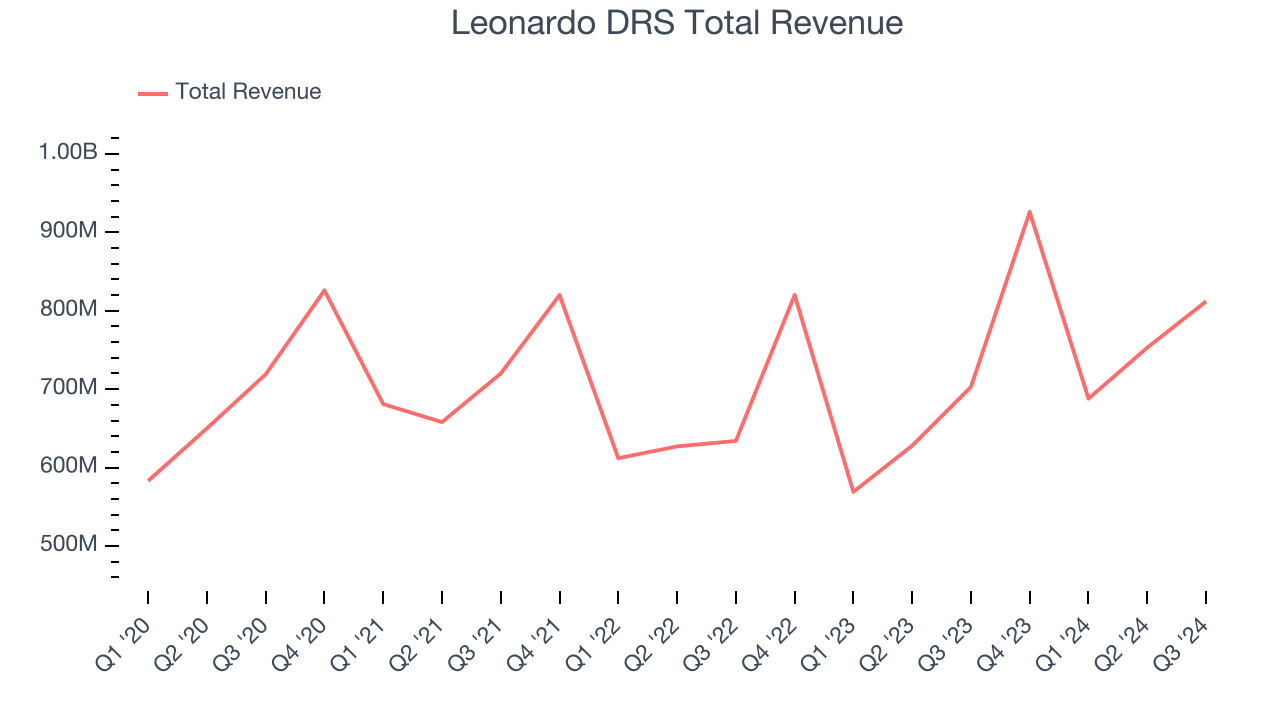

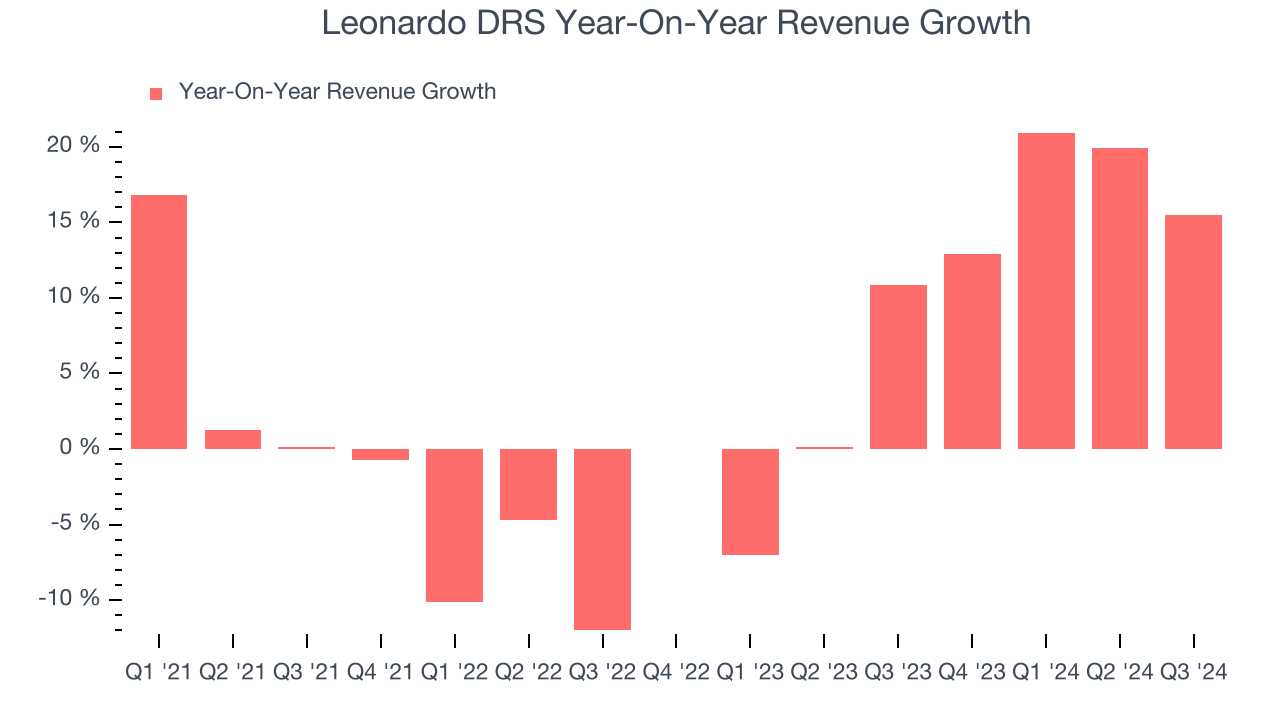

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Leonardo DRS’s 3.7% annualized revenue growth over the last four years was sluggish. This shows it failed to expand in any major way, a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. Leonardo DRS’s annualized revenue growth of 8.6% over the last two years is above its four-year trend, suggesting some bright spots.

We can better understand the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Leonardo DRS’s backlog reached $8.26 billion in the latest quarter and averaged 63.4% year-on-year growth over the last two years. Because this number is better than its revenue growth, we can see the company accumulated more orders than it could fulfill and deferred revenue to the future. This could imply elevated demand for Leonardo DRS’s products and services but raises concerns about capacity constraints.

This quarter, Leonardo DRS reported year-on-year revenue growth of 15.5%, and its $812 million of revenue exceeded Wall Street’s estimates by 4.7%.

Looking ahead, sell-side analysts expect revenue to grow 2.2% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates the market believes its products and services will see some demand headwinds.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Operating Margin

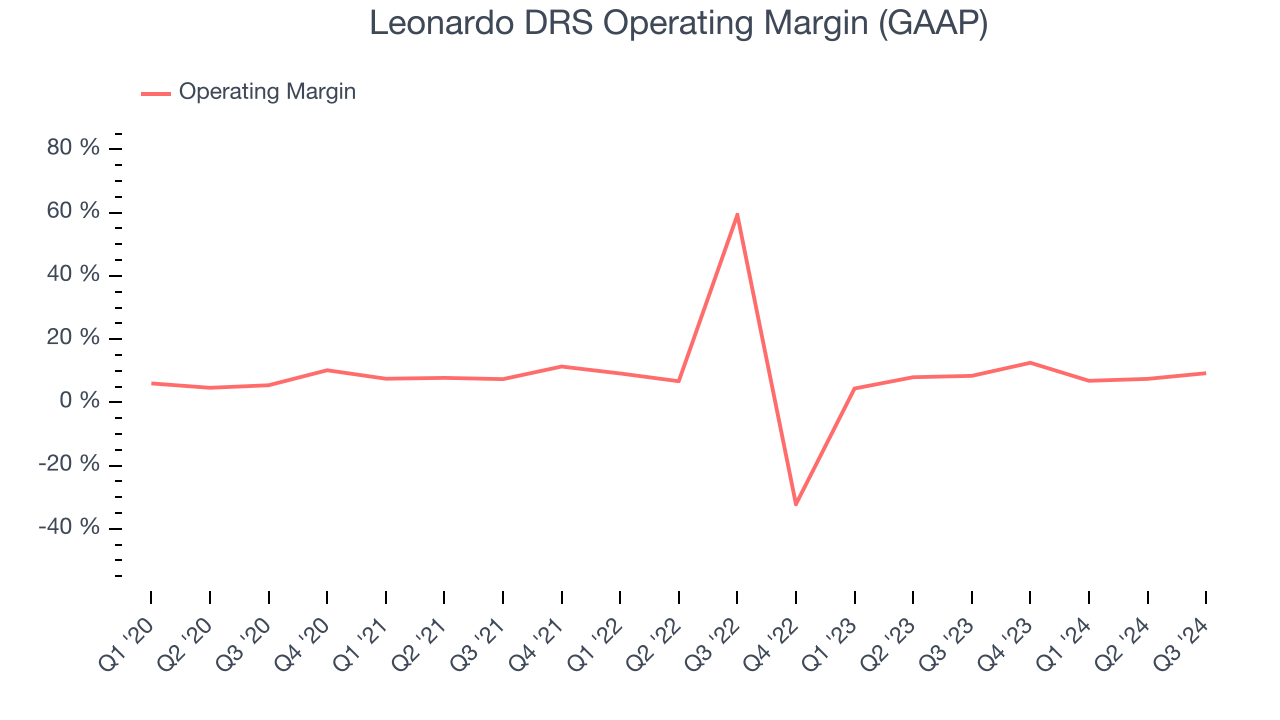

Leonardo DRS was profitable over the last five years but held back by its large cost base. Its average operating margin of 8% was weak for an industrials business.

On the bright side, Leonardo DRS’s annual operating margin rose by 2.6 percentage points over the last five years.

This quarter, Leonardo DRS generated an operating profit margin of 9.2%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

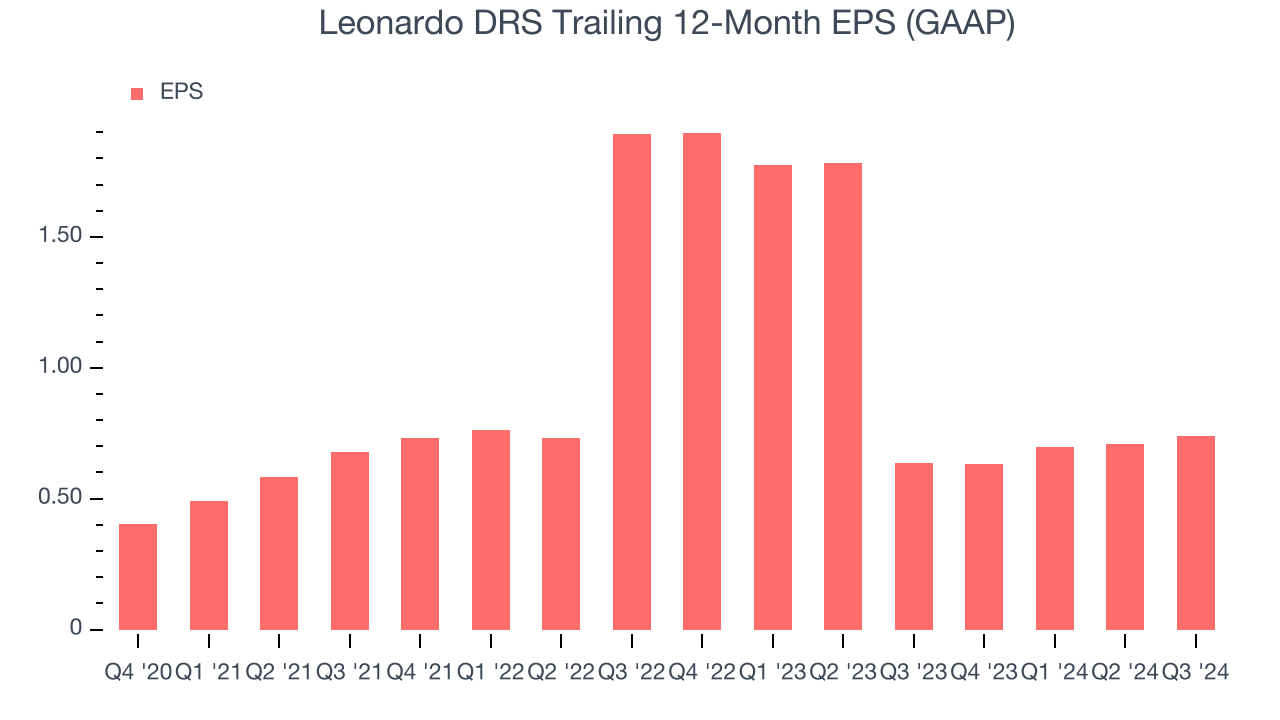

Earnings Per Share

Analyzing revenue trends tells us about a company’s historical growth, but the long-term change in its earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Leonardo DRS’s EPS grew at an astounding 26.8% compounded annual growth rate over the last four years, higher than its 3.7% annualized revenue growth. This tells us the company became more profitable as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Leonardo DRS, its two-year annual EPS declines of 37.5% mark a reversal from its (seemingly) healthy four-year trend. We hope Leonardo DRS can return to earnings growth in the future.In Q3, Leonardo DRS reported EPS at $0.21, up from $0.18 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Leonardo DRS’s full-year EPS of $0.74 to grow by 25.6%.

Key Takeaways from Leonardo DRS’s Q3 Results

We were impressed by how significantly Leonardo DRS blew past analysts’ revenue, EBITDA, and EPS expectations this quarter. We were also excited it lifted its full-year revenue and EBITDA/EPS guidance. Zooming out, we think this was a solid "beat and raise" quarter. The stock traded up 2.1% to $29 immediately following the results.

Leonardo DRS may have had a good quarter, but does that mean you should invest right now?What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.