Uber Technologies Inc. (NYSE: UBER) customers may notice something missing the next time they hop into their ride — a driver.

On Thursday, the ride-hailing leader teamed up with Alphabet’s Waymo subsidiary to launch fully autonomous vehicle (AV) transportation in Phoenix. The city will be among the first to offer a service that Uber hopes will be a nationwide shift in the way Americans get to business meetings and social engagements.

What driverless ride-hailing may lack in driver-passenger small talk, it makes up for with convenience. Once unlocking the vehicle from the Uber app, users will be able to connect to customer support 24/7 should they need assistance — or the score of the Arizona Diamondbacks World Series game.

Uber is hoping that the Waymo option will also appeal to environmentally conscious riders who would rather opt for an all-electric Jaguar I-PACE than Joe Schmo’s gas guzzler. The company is aiming for zero emissions mobility by 2040. Yes, one of the gig economy’s most popular side hustles appears destined for a future with fewer humans and more AVs.

The World Economic Forum forecasts that come Uber’s zero emission target date, AVs will represent 25% of the global transportation market. Chances are they’ll be transporting more than just people.

Earlier this month, Uber rolled out a package return service that looks to capitalize on the nation’s growing propensity for sending back online orders. The company is taking on the unenjoyable task as an extension of Uber Connect, which it launched during the height of the pandemic to help homebound Americans send stuff to family, friends and co-workers. The $5.00 ‘Return a Package’ offering ($3 for Uber One members) could be a big hit with consumers this holiday season by helping them to save time and get refunds faster.

Uber’s push into the courier industry suggests that the line between logistics and e-commerce is blurring. It could ultimately be a tailwind for companies like UPS and FedEx if it leads to more packages being sent their way — and looser online shopping habits tied to knowing there’s a $5.00 return fallback. In this scenario, Return a Package could drive higher e-commerce volumes as well.

Making food delivery more appetizing

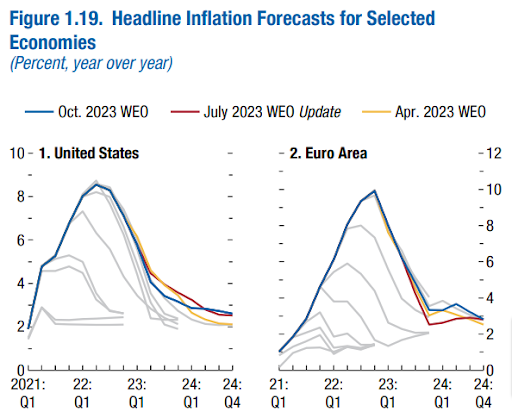

For the e-commerce slowdown to reverse course, inflation pressures will need to ease. Fortunately, there is a light at the end of the tunnel. The International Monetary Federation’s (IMF) latest World Economic Outlook predicts that headline inflation will revert towards 2021 levels by the end of next year in both the U.S. and Europe.

In the meantime, high prices on things like clothes, entertainment and dinners out will continue to weigh on U.S. discretionary spending. This also applies to restaurant to-go orders.

Knowing that consumers are ordering food delivery less often in this environment, Uber Eats is rolling out new app features to help households save money and gain greater access to food and grocery delivery, such as:

- Starting next year, Supplemental Nutrition Assistance Program (SNAP) recipients who often face transportation and disability barriers will be able to get groceries delivered by Uber using their SNAP benefits;

- Also, in 2024, Uber Eats will begin accepting FSA Cards, Flex Cards and waiver payments through collaborations with Managed Medicaid and Medicare Advantage health plan providers;

- the Uber Eats app will soon feature a Sales Aisle that puts restaurant deals and promotions in one spot, giving users more ways to save on takeout orders without having to hop from menu to menu;

- and of course, an app upgrade wouldn’t be complete without artificial intelligence (AI). Later this year, Uber Eats customers will be able to chat with an AI assistant to find deals, and new menu items and quickly reorder their favorite meals. Uber also plans to implement the technology for grocery store sale discovery, meal planning and budget-friendly ingredient ordering.

Uber Eats’ move to boost its money-saving tech capabilities (and customer base) follows last month’s kickoff of Undefeated Deals, a multi-company promotion targeting National Football League (NFL) and college football viewers. This includes a tie-up with Wingstop that gives Uber One members exclusive access to the new Bayou BBQ Blitz flavor along with other savings and freebies. The season-long promo will see Uber Eats team up with Little Caesars, Taco Bell, Wendy’s, Popeyes and others on delivery deals. This week’s deal? Panera BOGO Mac & Cheese.

Delivering stronger financial results

Investors may get their first indication of the success of this year’s Undefeated Deals campaign when Uber reports its third quarter financial results pre-market on November 7th. Wall Street is projecting that the company will post a $0.07 per share profit on roughly $9.5 billion in sales. But if the last go around is any indication, Uber may overdeliver.

When Uber announced second quarter results on August 1st, analysts were braced for a penny per share net loss. Instead, management boasted a $0.18 per share profit that marked a sharp turnaround from Q2 of 2022 when the company recorded a $1.33 per share loss. The swing to profitability reflected an increase in customer bookings led by a 25% jump in Mobility bookings (and complemented by 12% Delivery bookings growth) along with cost-cutting measures.

The performance showed that despite the economic headwinds, consumers have been willing to spend on both transportation and food delivery. As pandemic fears continue to ease, Uber finds itself in a more normalized operating environment — and it’s showing up in its financials. After falling 14% to $11 billion in 2020, revenue is on pace to rise for the third straight year to more than $36 billion in 2023.

Better yet, Uber’s top-line growth is finally coinciding with profits. Following four consecutive years in the red, the Street is anticipating earnings per share (EPS) of $0.34 this year. Although the return to profitability has been inconsistent quarter to quarter, the leadership team feels it is out of the woods.

During last quarter’s earnings call, CEO Dara Khosrowshahi boldly proclaimed, “we plan to be profitable for every quarter going forward.” It would be a welcomed development for shareholders who have seen the company struggle to string together two profitable quarters in a row. A potential underappreciated catalyst for third-quarter earnings — the back-to-college season and its effect on Uber Eats and bar hopping ride demand.

MarketBeat Stock Comparison tool: Uber vs. Lyft

So if Uber’s financials are on the rebound, then industry peer Lyft must be doing well too. Yes and no.

Lyft is also on track to swing to profitability in 2023 thanks to improving rideshare demand and driver availability—however, a heavy debt burden and a lack of innovation point to a milder earnings growth outlook. Analysts are forecasting that Lyft will grow EPS by 24% in 2024 compared to 106% EPS growth for Uber. Combined with declining revenue per active rider and rising operational costs, this is why investors have preferred to reserve Uber shares.

MarketBeat’s Stock Comparison tool reveals that Uber’s stock performance is miles ahead of Lyft’s stock performance. Uber has a 12-month return of approximately 50% versus a -34% return for Lyft. The valuable resource also highlights differences in fundamental quality and market sentiment in favor of Uber. A key reason for the variance is Lyft’s sole focus on ride-hailing compared to Uber’s more diversified business model.

Wall Street is ‘Uber-bullish’

But if Uber stock is up so much compared to Lyft and both are in the ground transportation industry, then the latter must be the better investment. Not so fast.

On the surface, Lyft does look like the better deal. It is trading around 18x next year’s earnings while Uber goes for 38x 2024 earnings. Remember, though, that Uber’s profits are expected to double next year — that’s more than four times the profit growth that is expected from Lyft. Uber’s valuation, therefore, arguably deserves to be at a much higher premium to its closest competitor.

It makes sense then that Wall Street sees both stocks heading higher over the next 12 months — but Uber doing better. The current consensus price target on Uber is $59.00, which implies more than 40% upside from Friday’s close. Despite its lower share price, Lyft has a lower percentage gain ahead (~30%), according to analysts. More importantly, only three analysts have buy ratings on Lyft. A near-perfect 29 of 30 analysts are presently bullish on Uber.

Bottom line

Uber is benefiting from a recovery in consumer demand for both local transportation and food delivery. With a pair of growing businesses and full-year profitability near, the company is aggressively launching new technologies and services, from self-driving cars to package returns. There is momentum in the business, and management’s confidence reflects it.

The stock’s recent pullback from $49.49 to $41.23 is a result of the broad market downturn rather than something company-specific. This has created a favorable entry point for 1) swing traders who can capitalize on the stock peeking outside of its lower Bollinger band (see daily chart above) as well as 2) UBER investors in it for the long haul.