- Nearly nine in ten advisors agree that yield is back.

- Most think inflation and interest rates haven’t peaked yet, two factors that many advisors cite as the top risks to bond portfolios.

- Consensus is split on performance of long vs. short duration; More advisors are concerned about duration risk than credit or default risk.

- Seven in ten advisors agree that active management of bond funds makes the most sense in the current environment.

After 10 interest rate hikes over the past year, and with the federal funds target rate at a 15-year high, 86% of financial advisors agree that bond yields are back. In fact, 89% say this is the best yield opportunity they have seen in years, with 69% also saying this is the best return opportunity for bonds since before the global financial crisis, according to a new fixed income pulse survey of 350 US-based financial advisors who manage $1.7 billion in client assets, conducted by Natixis Investment Managers and Loomis Sayles.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230503005277/en/

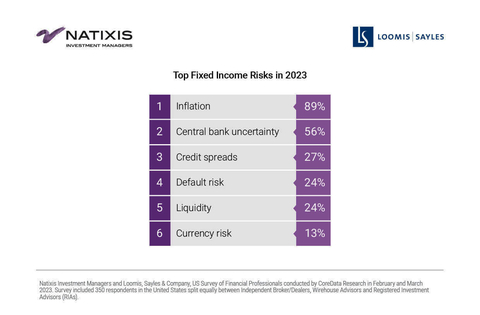

Top Fixed Income Risks in 2023 (Graphic: Business Wire)

While advisors have strong convictions about the resurgence in yield, inflation remains their top risk concern (89%), followed by central bank policy uncertainty (56%). Most (69%) agree that lower inflation would make bonds more attractive, yet 60% don’t think that inflation or interest rates have peaked yet. The consensus is split in their views on duration, and 58% of advisors say they aren’t comfortable taking on duration risk. Other key findings:

- 58% believe short duration will outperform this year, and those who share this outlook also are more inclined to agree that inflation has not yet peaked (71%). Of the 42% who are betting on longer durations, 55% think inflation already has peaked.

- 69% believe bonds have not yet fully decoupled from equities after seeing bonds and stocks both lose ground least year.

- 32% are worried about missing the right entry point into the bond markets.

- 80% agree that in the current environment, it’s important to work with an experienced, active bond manager, and 71% say active management makes more sense than passive for fixed income.

“Interest rates at or near all-time lows have held bonds to historically low yields, forcing many investors to go further afield not only for income but also for risk management,” said Rick Raczkowski, executive vice president, portfolio manager and co-head of the Loomis Sayles relative return team. “After the past year’s rate hikes, 80 percent of advisors look to bonds to produce income, and three in four say that bonds once again are ballast in portfolios during times of volatility.”

Beyond yield: Advisors also looking to fixed income for risk management

While many advisors see fixed income as a way to generate income for clients, they are even more likely to see fixed income as a way to mitigate portfolio risk by enhancing diversification (85%). Similarly, two-thirds of advisors (67%) see fixed income as helping to minimize risk of loss.

Despite the renewed focus on fixed income’s properties for generating income and providing risk management, surprisingly few advisors are looking for the asset class to fulfill other traditional roles associated with it. Even though they see this as the best return opportunity for bonds in 15 years, less than half of advisors (47%) are looking to pursue total return with their fixed income investments. Given that they are shying away from the duration risk inherent in government bonds and focusing on credit risk, only 45% are looking for tax efficiency out of fixed income holdings—another time-honored function of bonds.

What’s keeping advisors up at night? Inflation. Rates. Then everything else.

At roughly 5%, inflation may be about half of its peak a year ago, but it remains generationally high and more than double the Federal Reserve’s 2% target rate, leaving the possibility of additional rate hikes, in our opinion. With the potential for a recession on companies’ radar for months, they have had time to strengthen their balance sheets and streamline operations to prepare for any recessionary impacts. As a result, many advisors have less concern about credit and default risks since companies appear to be actively preparing for a recession.

The survey found:

- 66% of advisors worry that high inflation could linger longer than expected.

- 50% worry that this could push rates higher than anticipated, with 33% saying rates could stay higher for longer than expected.

- Other common fixed income concerns trail well behind, including credit spreads (27%), default risk (24%), liquidity (24%) and currency risk (13%).

Some observers have been surprised at how little impact Wall Street seems to have had on the debate in Washington over a possible debt ceiling showdown between the Republican-led House and the Biden administration. The lack of concern is borne out by the fact that just 15% of advisors say they are losing any sleep over the impact the showdown could have on bonds.

Looking ahead: What advisors expect

With the rates on 10-year US Treasurys hovering around 3.5% and more hikes likely, most advisors project rates between 3.5% and 3.99% (31%) or 4.0% and 4.49% (28%)—both still far short of the historical average of 5.89%. So, a combined three in five (58%) advisors think rates will remain range-bound, which should reduce concerns about potential duration risk.

With uncertainties about inflation and rates, 77% of advisors believe active investments will outperform passive investments. Two-thirds (66%) believe traditional fixed income will outperform alternatives. Six in 10 (59%) also project that investment-grade bonds will outperform high-yield bonds (41%).

Advisors continue to use more tried-and-true investment structures, with 87% using bond funds and 73% investing in passive ETFs. However, consistent with their view that active will outperform passive, 58% also are finding a place for active ETFs in their portfolios, and 66% say active ETFs are an increasingly attractive option for fixed income.

Speaking with clients in the new fixed income world

“Many advisors recognize that their biggest challenge may not be when to increase their exposure to bonds but how to bring clients along in the decision,” says Dave Goodsell, Executive Director of the Natixis Center for Investor Insight. “After a tumultuous year for fixed income investors in 2022, they will need to help clients overcome post-traumatic stress. They need to re-educate clients on how rates and bonds work and show them why fixed income allocations are essential to a portfolio that can meet income, return and diversification goals.”

The biggest challenges advisors identified when speaking to clients about bond funds:

- Many clients think bonds should never lose money (59%)

- People felt burned by bonds in 2022 (48%)

- Inflation makes people worried about locking in interest rates (38%)

- Some clients believe that fixed income is only for “old people” (26%)

As a result, the survey found that advisors need an expanded mix of investment structures to respond to clients increasing desire for customized fixed income solutions: Nearly half of advisors (49%) say they would like to know more about building fixed income portfolios to meet high client expectations.

A full report on the survey findings can be found at: https://www.im.natixis.com/us/research/fixed-income-pulse-survey

Methodology

The Natixis Investment Managers and Loomis, Sayles & Company US Survey of Financial Professionals was conducted by CoreData Research in February and March 2023. The survey included 350 respondents in the United States, split equally between independent broker/dealers, wirehouse advisors and registered investment advisors (RIAs).

About Loomis Sayles

Since 1926, Loomis, Sayles & Company has helped fulfill the investment needs of institutional and mutual fund clients worldwide. The firm’s performance-driven investors integrate deep proprietary research and risk analysis to make informed, judicious decisions. Teams of portfolio managers, strategists, research analysts and traders collaborate to assess market sectors and identify investment opportunities wherever they may lie, within traditional asset classes or among a range of alternative investments. Loomis Sayles has the resources, foresight and the flexibility to look far and wide for value in broad and narrow markets in its commitment to deliver attractive, risk-adjusted returns for clients. This rich tradition has earned Loomis Sayles the trust and respect of clients worldwide, for whom it manages $302.1 billion* in assets (as of 31 March 2023).

*Includes the assets of both Loomis, Sayles & Co., LP, and Loomis Sayles Trust Company, LLC. ($35.7 billion for the Loomis Sayles Trust Company). Loomis Sayles Trust Company is a wholly owned subsidiary of Loomis, Sayles & Company, L.P.

About Natixis Investment Managers

Natixis Investment Managers’ multi-affiliate approach connects clients to the independent thinking and focused expertise of more than 15 active managers. Ranked among the world’s largest asset managers 1 with more than $1 trillion assets under management 2 (€1 trillion), Natixis Investment Managers delivers a diverse range of solutions across asset classes, styles, and vehicles, including innovative environmental, social, and governance (ESG) strategies and products dedicated to advancing sustainable finance. The firm partners with clients in order to understand their unique needs and provide insights and investment solutions tailored to their long-term goals.

Headquartered in Paris and Boston, Natixis Investment Managers is part of the Global Financial Services division of Groupe BPCE, the second-largest banking group in France through the Banque Populaire and Caisse d’Epargne retail networks. Natixis Investment Managers’ affiliated investment management firms include AEW; DNCA Investments; 3 Dorval Asset Management; Flexstone Partners; Gateway Investment Advisers; Harris Associates; Investors Mutual Limited; Loomis, Sayles & Company; Mirova; MV Credit; Naxicap Partners; Ossiam; Ostrum Asset Management; Seventure Partners; Thematics Asset Management; Vauban Infrastructure Partners; Vaughan Nelson Investment Management; and WCM Investment Management. Additionally, investment solutions are offered through Natixis Investment Managers Solutions and Natixis Advisors, LLC. Not all offerings are available in all jurisdictions. For additional information, please visit Natixis Investment Managers’ website at im.natixis.com | LinkedIn: linkedin.com/company/natixis-investment-managers.

Natixis Investment Managers’ distribution and service groups include Natixis Distribution, LLC, a limited purpose broker-dealer and the distributor of various U.S. registered investment companies for which advisory services are provided by affiliated firms of Natixis Investment Managers, Natixis Investment Managers S.A. (Luxembourg), Natixis Investment Managers International (France), and their affiliated distribution and service entities in Europe and Asia.

1 Cerulli Quantitative Update: Global Markets 2022 ranked Natixis Investment Managers as the 18th largest asset manager in the world based on assets under management as of December 31, 2021. |

2 Assets under management (“AUM”) of affiliated entities measured as of December 31, 2022 are $1,151.3 billion (€1,078.8 billion). AUM includes AlphaSimplex Group, LLC ($8.2 billion / €7.7 billion), which was acquired by Virtus Investment Partners, Inc., effective April 1, 2023. AUM, as reported, may include notional assets, assets serviced, gross assets, assets of minority-owned affiliated entities and other types of non-regulatory AUM managed or serviced by firms affiliated with Natixis Investment Managers. |

3 A brand of DNCA Finance. |

5650774.1.1

MALR30947

View source version on businesswire.com: https://www.businesswire.com/news/home/20230503005277/en/

Contacts

Press:

Kelly Cameron

Natixis Investment Managers

+ 1 617 449 2543

Kelly.Cameron@natixis.com

Kate Sheehan

Loomis, Sayles & Company

+ 1 617 960 4447

KSheehan@loomissayles.com