Ford Credit Ranks Highest in Mass Market Segment for Second Consecutive Year

As auto leasing volume continues to fall—now accounting for just 17% of total new-vehicle sales—and lease options for customers are limited, lenders need to focus on bringing their lease customers back to the brand. According to the J.D. Power 2023 U.S. End of Lease Satisfaction Study,SM released today, the key to attracting and retaining those customers is understanding when lessees make their decisions and how best to communicate with them at the right moment.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230330005015/en/

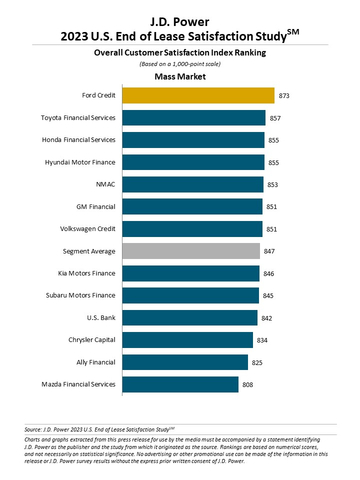

J.D. Power 2023 U.S. End of Lease Satisfaction Study (Graphic: Business Wire)

“In this market, lenders need to take actions that create and maintain brand loyalty,” said Patrick Roosenberg, director of automotive finance intelligence at J.D. Power. “Because there are fewer lease opportunities, the best course of action is for lenders to do everything in their power to maintain their current customers. In that effort, we compare the different end of lease journeys, between customers that are brand loyal and those that leave the brand, to identify and understand lender specific actions that affect loyalty. According to our data, the optimal recapture point is long before a customer ever sets foot in a dealership. The greatest opportunity to retain lease customers is six to nine months before vehicle turn-in. By being proactive with their communication, knowing when it should begin and understanding the communication channels customers value, lenders maximize their chances to forge a brand loyalty with a customer that can pay dividends for years to come.”

Study Rankings

Ford Credit ranks highest in end of lease satisfaction in the mass market segment for a second consecutive year, with a score of 873. Toyota Financial Services (857) ranks second, while Honda Financial Services (855) and Hyundai Motor Finance (855) rank third in a tie.

The 2023 U.S. End of Lease Satisfaction Study identifies lease-end practices and timely marketing opportunities that optimize lease retention for the same brand and at the same dealer. The study is based on responses from 2,513 mass market lease customers who have ended an auto lease within the past nine months of the survey period. The study was fielded from November 2022 through January 2023.

For more information about the U.S. End of Lease Satisfaction Study, visit

https://www.jdpower.com/business/end-lease-satisfaction-study.

See the online press release at http://www.jdpower.com/pr-id/2023031.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

View source version on businesswire.com: https://www.businesswire.com/news/home/20230330005015/en/

Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com