NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES.

VANCOUVER, BC / ACCESSWIRE / June 11, 2021 / Great Atlantic Resources Corp. (TSXV.GR) (the "Company" or "Great Atlantic"), is pleased to announce that it has closed its private placement offering (the "Offering") for aggregate gross proceeds of approximately $2,060,000, consisting of: (i) $1,360,000 in flow-through units of the Company (the "FT Units") at a price of $0.68 per FT Unit, and (ii) $700,000 in units of the Company (the "Units") at a price of $0.50 per Unit.

Each FT Unit is comprised of one common share of the Company that will qualify as a "flow-through share" within the meaning of subsection 66(15) of the Income Tax Act (Canada) (the "Tax Act") (a "FT Common Share") and one common share purchase warrant of the Company (a "Warrant"). Each Unit is comprised of one common share of the Company (a "Common Share") and one Warrant. Each Warrant entitles the holder to purchase one Common (a "Warrant Share") at an exercise price equal to $0.75 at any time up to 36 months from closing of the Offering.

The gross proceeds from the sale of FT Units (other than the minimal amount allocable to the Warrants) will be used for exploration expenses on the Company's mining projects as permitted under the Tax Act to qualify as Canadian Exploration Expenses ("CEE") as defined in the Tax Act. The FT Common Shares, Common Shares and the Warrant Shares to be issued under the Offering have a hold period of four months and one day closing of the Offering.

In a second-step transaction, and part and parcel of the completion of the Offering, Eric Sprott, through 2176423 Ontario Ltd., a corporation that is beneficially owned by him, acquired 2,000,000 Units for approximate consideration of $1,000,000. Subsequent to the closing of the offering, Mr. Sprott beneficially owns or controls 2,000,000 Common Shares of the Company and 2,000,000 Warrants, representing approximately 9.2% of the issued and outstanding common shares of the Company on a non-diluted basis and approximately 16.9% of the issued and outstanding common shares of the Company on a partially diluted basis, assuming exercise of the Warrants forming part of the Units acquired. Prior to the offering, Mr. Sprott did not beneficially own or control any securities of the Company.

The Units were acquired by Mr. Sprott for investment purposes. Mr. Sprott has a long-term view of the investment and may acquire additional securities of Great Atlantic Resources, including on the open market or through private acquisitions, or sell securities of the company, including on the open market or through private dispositions in the future, depending on market conditions, reformulation of plans and/or other factors that Mr. Sprott considers relevant from time to time.

A copy of Mr. Sprott's early-warning report will be filed under Great Atlantic's profile on SEDAR and may also be obtained by calling Mr. Sprott's office at 416-945-3294 (200 Bay St., Suite 2600, Royal Bank Plaza, South Tower, Toronto, Ontario M5J 2J1).

In connection with the Offering, the Company issued Units and broker warrants to a finder. Each broker warrant is exercisable to acquire one Unit at $0.50 per Unit for a period of 36 months from the issuance date thereof.

On Behalf of the board of directors

"Christopher R Anderson"

Mr. Christopher R. Anderson "Always be positive, strive for solutions, and never give up"

President CEO Director

604-488-3900 - Dir

Investor Relations:

Please call 604-488-3900

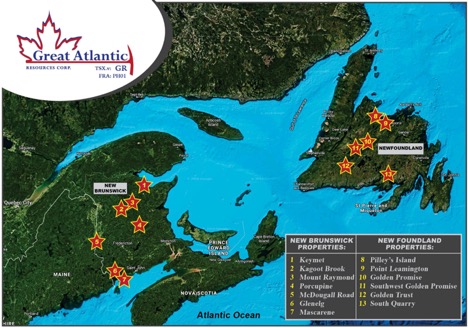

About Great Atlantic Resources Corp.: Great Atlantic Resources Corp. is a Canadian exploration company focused on the discovery and development of mineral assets in the resource-rich and sovereign risk-free realm of Atlantic Canada, one of the number one mining regions of the world. Great Atlantic is currently surging forward building the company utilizing a Project Generation model, with a special focus on the most critical elements on the planet that are prominent in Atlantic Canada, Antimony, Tungsten and Gold.

Forward-looking statements: This press release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts, that address future exploration drilling, exploration activities and events or developments that the Company expects, are forward looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include exploitation and exploration successes, continued availability of financing, and general economic, market or business conditions.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Great Atlantic Resource Corp

888 Dunsmuir Street - Suite 888, Vancouver, B.C., V6C 3K4

SOURCE: Great Atlantic Resources Corp.

View source version on accesswire.com:

https://www.accesswire.com/651392/Great-Atlantic-Completes-20-Million-Offering-Backed-by-Mr-Eric-Sprott