If you’re new to options — or just looking to uplevel your options trading game — options trading alerts can be a powerful tool to add to your repertoire.

The right options alert service can’t do all the heavy lifting for you — you should actively avoid any services that make unrealistic promises. However, a reputable service can alert you to opportunities you might not have considered otherwise.

Consider options trading alerts as a head start on your due diligence process. They can point you in the right direction, which can save you valuable research time. Plus, they can potentially lead you to money-making opportunities!

However, not all options trading alerts are created equal. That’s why we’ve developed a screening process to determine if options alert services are any good:

- Average price per alert

By considering the cost of the service compared to the number of alerts you receive, you can figure out how much money you’d need to make per trade to make the options alert service worthwhile. Of course, this is an imperfect metric, because it doesn’t factor in the value that you get from learning while watching. But it is a good one to get a quick read on the cost vs. value of the service.

- Potential returns

Every trader wants to make money, right? But it’s worth remembering that risk and reward are often part of the same package in the world of options trading.

The higher the amount of the projected annual return, the more risk you’re likely to assume. So if options alerts services advertise annual returns in the triple digits, you might have to deal with potentially big drawdowns. Can you stomach it?

- Options trading style

There are many ways to approach trading options.

Are you drawn to small wins, but a higher win rate? Or, are you interested in big gains, even if it means a very low win rate?

There isn’t a right or wrong answer here. But your approach should be in line with the options alert service you choose. If you try to force yourself into a style that isn’t in line with the way you like to trade, it probably won’t be a good match.

Using these three criteria as the trinity of filtering alerts services, let’s consider some of the top option trading alert services out there. All of these services have something to offer — it’s a matter of deciding which one will work best for you.

What’s the Best Options Trading Alerts Service? 6 Top Picks- Top Overall Pick: StockNews POWR Options

- Top Options Alerts for Well-Rounded Picks: The Trading Analyst

- Best Options Trading Alerts for Swing Traders: Motley Fool Options

- Best Option Alert Service for Small Accounts: Benzinga Options

- Best Options Alert Service for Beginners: Sky View Trading

- Best Options Alert Service for Potential High Returns: The Speculator

(Source: StockNews)

Rating: 10/10

- Cost: $1 for a 30-day trial; $66.42 per month with a 1-year plan

- Historical returns: 55.24% gains since 2021

- Style: Options trades based on the POWR Ratings model

Admittedly, we’re biased — but we strongly believe that our POWR Options service is one of the best options trading alerts services. Here’s why.

Since launching in 2021, StockNews’ POWR Options service has leveraged StockNews’ proprietary POWR ratings model (a method of grading stocks based on various criteria) to locate high-conviction options trades with a +55.24% return. That’s especially impressive considering this average includes the 2022 bear market.

Options trading can get complicated, but POWR Options keeps things simple. It focuses on the simplest trades, such as Calls and Puts, that investors at any level can understand.

With Call options, they only focus on A and B-rated POWR stocks that have a proven track record in the market since 1999, which puts the odds in the service’s favor.

With Put options, they focus on D and F-rated POWR stocks that have historically leaned red — this aligns with Put options, where you make money when the stock price declines.

The service is guided by Tim Biggam, a market professional who has been active since the 1980s. He’s seen both bull and bear markets and has a deep understanding of market risk and how emotions can play into the trading process.

As a member, you’ll receive:

- Call and Put options trades, leveraging the POWR ratings system…

- Immediate trade alerts by email or text, letting you know when and why to buy and sell…

- Weekly commentary including market updates and trading plans.

Since the service doesn’t specify a specific number of alerts per month, it’s hard to average out the cost per alert. But with the $1 30-day trial, it’s easy enough to see for yourself if the service provides value.

2. Top Options Alerts For Well-Rounded Picks: The Trading Analyst

(Source: The Trading Analyst)

Rating: 10/10

- Cost: $147 monthly, or $787 annually

- Historical returns: The Trading Analyst claims an internal rate of return of 141%

- Style: Swing trades with potentially high returns

One of the biggest reasons The Trading Analyst gets top billing? It’s completely honest about the risk you’ll assume as an options trader. Risk management is the name of the game.

As they say on their website, “Since July of 2018, we’ve had 337 winning swing trades and 302 losing trades. But it’s our risk management that really sets us apart from the rest. Our average win is $4,324.02 — while our average loss is -$2,603.29. This gives us a profit factor of 1.66. Our portfolio (starting equity of $100,000 in July 2018) grew to $771,001.67 by the end of July 2023.”

Their process seems to work. The fact that the win size is bigger than the loss size, plus the fact that they boast a win rate over 50%, is not common in the world of options. Plus, the actual alerts are robots. You can expect between 2 and 10 alerts per week, or an average of roughly 165 per year. That equals about $7.75 per trade alert.

One thing to note? The Trading Analyst is not for the faint of heart. Their hypothetical portfolio assumes a $100,000 balance to begin with, and the reported average loss size is just over $2500. This adds up to a 2.5% risk of your portfolio on every trade. A losing streak could quickly have a big impact on your portfolio in a case like this.

3. Best Options Trading Alerts for Swing Traders: Motley Fool Options

(Source: Motley Fool Options)

Rating: 8/10

- Cost: $999 annually

- Historical returns: Not specified, but the team claims to have made money on 86% of completed trades

- Style: Selling put options

Motley Fool Options claims an impressive 86% win rate. How do they maintain that high level? The service primarily focuses on selling out-of-the-money put options. Since many options expire worthless, profits go to those who sell the contracts.

However, here’s the problem with a great win rate. The losses can be big when you find yourself in a situation where you sell a put option, but before it expires, the stock experiences a big drop. If this happens, you might be on the line to pay more than the market value for a given stock. This puts you in a situation where you might need to hold for a long time for the shares to bounce back; if you need to sell before that point, you could have a big loss on your hands.

With Motley Fool Options, the number of alerts can vary, but they attempt to deliver at least 2 per month. At that rate, each alert might cost as much as $37.50, which might be high if you’re trading with a small account. Then again, if you’re learning from the experience, you could chalk it up to market experience.

Speaking of experience, you can gain more knowledge and experience with Motley Fool’s extensive educational resources, which can help offset the cost.

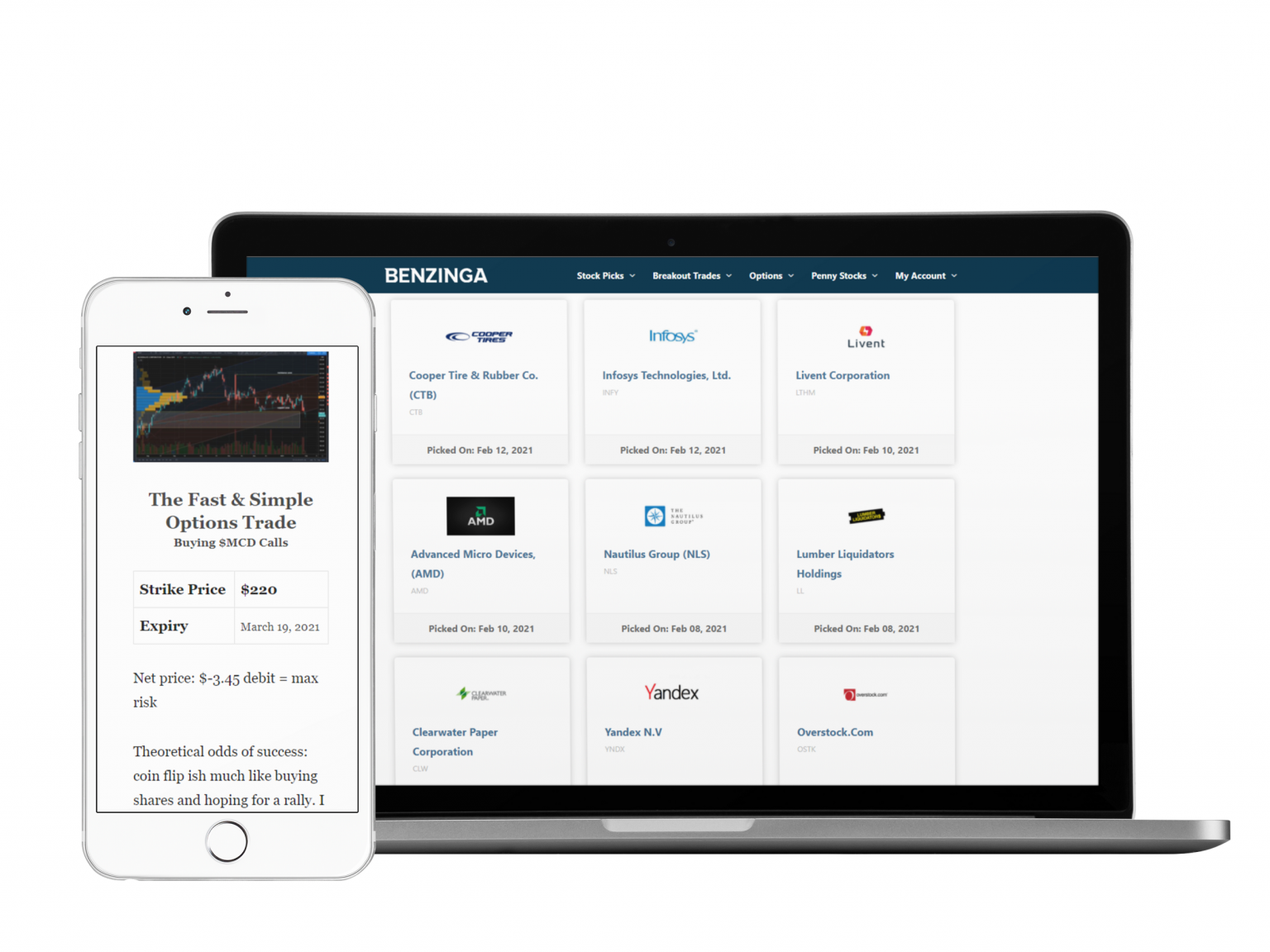

4. Best Option Alert Service for Small Accounts: Benzinga Options

(Source: Benzinga Options)

Rating: 7/10

- Cost: $297 annually (you can get a discount on the first year)

- Historical returns: Not specified, but the services advertises a 90%+ win rate

- Style: High-probability trades from a guru

Benzinga Options is offered by Benzinga’s in-house options guru, Nic Chahine. It’s primarily geared toward newbie options traders, whether or not they have stock market experience. His simple, easy-to-read alerts are designed for user-friendly implementation. His track record speaks volumes: he has a staggering 90%+ win rate.

Chahine keeps the odds in his favor by focusing on high-probability trades such as selling options. Strategies like credit spreads and naked puts let you collect options premiums, which you then keep if the options expire worthless.

However, a high win rate often means that each individual win will likely be small. Chahine isn’t going for home runs. He’s going for singles. There might be an unusually large win or loss from time to time, but overall his win rate makes up for it in the long run.

Benzinga Options sends out at least 2 alerts per month, which averages out to about $12.75 per alert. This is great news for those with smaller account sizes.

If you’re interested in high-probability trades and lower risk but lower returns, this might be the service for you.

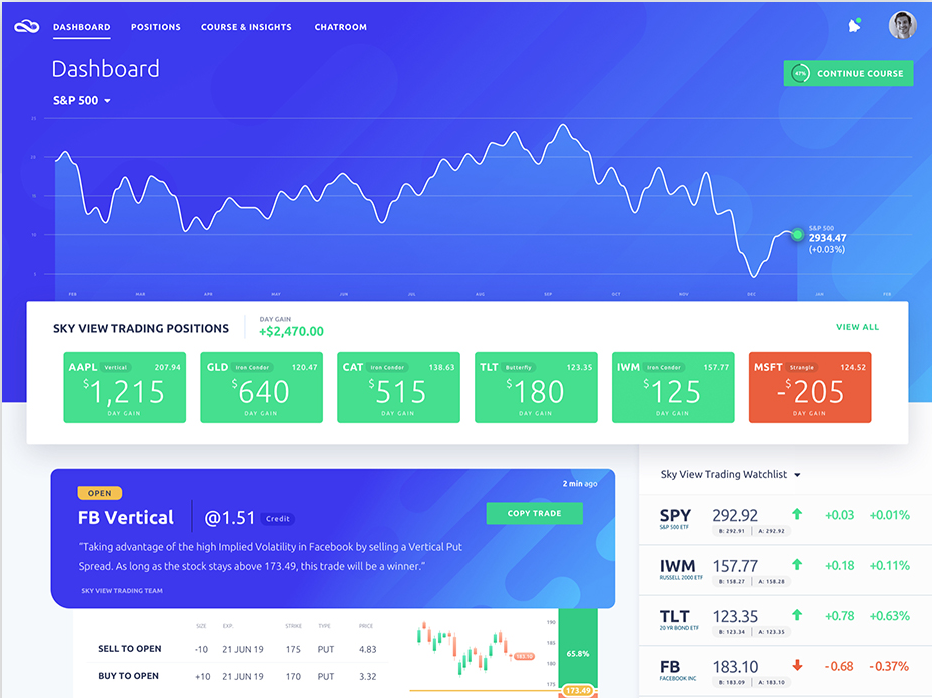

5. Best Options Alert Service for Beginners: Sky View Trading

(Source: Sky View Trading)

Rating: 6/10

- Cost: $496 for first 6 months, then $99 per month after

- Historical returns: As of February 2024, the company claims to have outperformed the S&P 500 by over 60% the last 3 years

Style: Option-selling strategies including credit spreads

Sky View Trading claims an impressive 91% win rate since 2016. This might seem too good to be true, but it is possible with services focusing on premium selling strategies such as out-of-the-money credit spreads — ways to make small gains consistently. Of course, this can become a losing strategy fast if you risk too much on a single trade — there are no sure things in the market. Even with a 91% win rate, those 9% of losses could be big.

If none of what you just read made sense, good news — Sky View offers a ton of resources to bring you up to date, starting with an Options JumpStart™ course featuring over 4 hours of videos detailing options strategies. You’ll learn directly from Adam Thomas, the company’s founder. Plus, you’ll also have access to a discord room to connect with other up-and-coming options traders.

Sky View offers at least three alerts per week, so there’s always something to consider. This program is great for new traders who want a little hand-holding and are willing to put in the time to learn about options.

The one complaint about the service? The fees are kind of confusing. On their checkout page, they offer a “6-month free trial and a $496 sign-up fee” — which kind of seems at odds with itself. After that intro, you’ll be charged $99 per month.

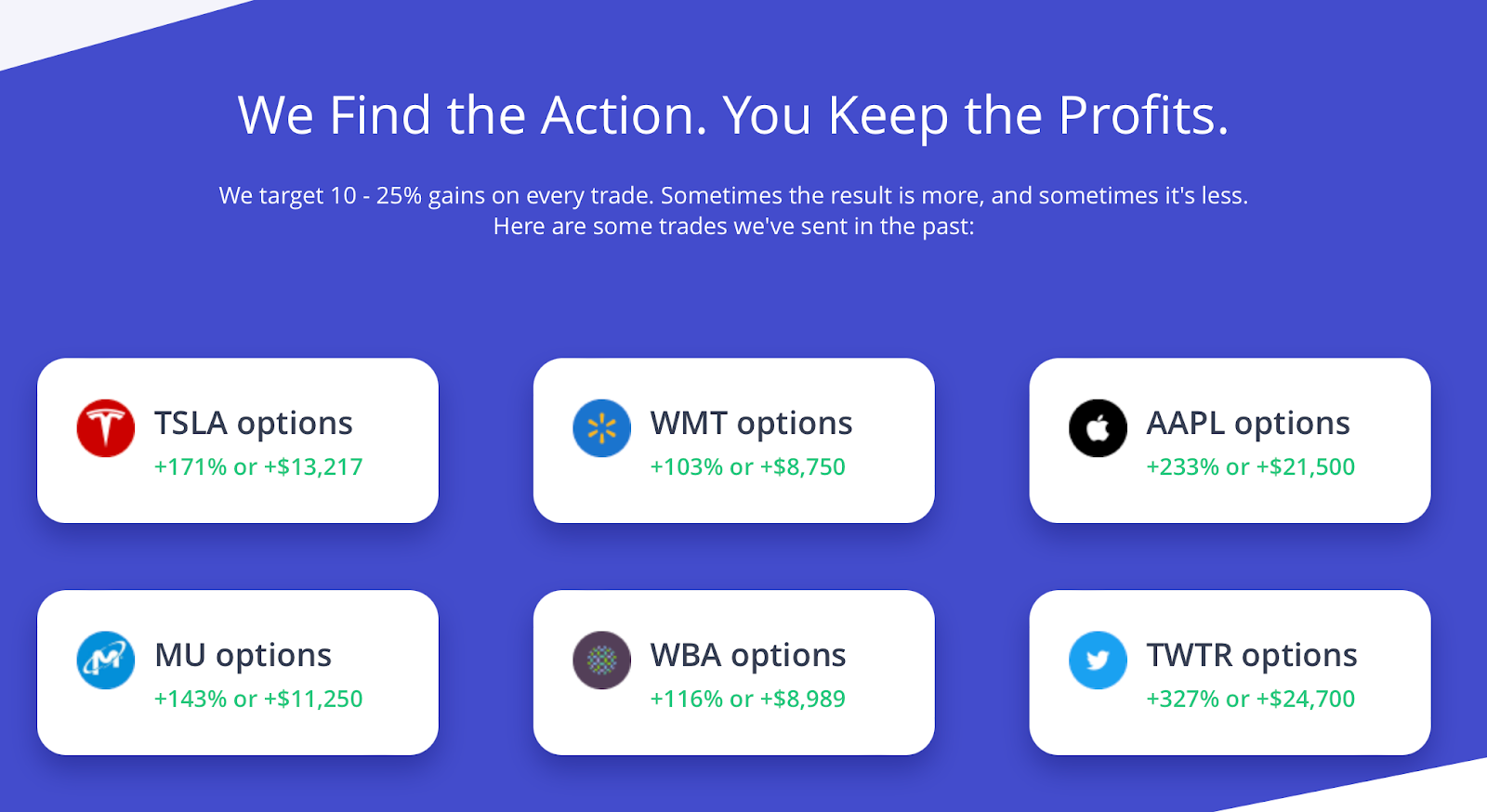

6. Best Options Alert Service for Potential High Returns: The Speculator

(Source: InvestorsPlace)

Rating: 7/10

Cost: $1499 annually

Historical returns: Not stated; tipranks suggests over 50%

Style: LEAPs on high-risk, high-reward stocks

At the helm of The Speculator is Eric Fry, a millionaire who has spent the last 3 decades in Silicon Valley and Wall Street. He looks to locate the next megatrends before they kick off — particularly if options traders can take advantage of them. He’s a millionaire, so he’s not scared to leverage potential opportunities with LEAPs (Long-Term Equity Anticipation Securities) which are known as one of the most expensive types of options. He loves out-of-the-money options with a year or more until they expire.

Typically, these options have a fairly low chance of being profitable on the expiration date. However, the few that are profitable can be VERY profitable — we’re talking triple-digit returns or more.

But — and you shouldn’t forget this — this means that this strategy will likely have a less than 50% win rate. The idea is that the wins will make up for the losses over time, but Fry’s strategy isn’t for everyone. If you’re not comfortable with drawdowns, this might not be for you.

Then again, according to Tipranks, Eric’s estimated success rate is 64%, and his average gains are 51%.

In terms of frequency, there are only 24 to 48 picks per year, which means the service could cost as much as $62 per alert. This might rule out some small accounts.

Then again, you’ll probably learn a lot. The Speculator offers thorough analysis and commentary so you can learn as you follow. It lacks the basic options education some other services have, but if you can DIY that part and prefer to learn by doing, this could be right for you.

Eric’s impressive track record in a potentially risky strategy is what puts this service on the list.

Conclusion: Options Trading Alerts For Every Style

Options trading isn’t easy. Finding high-potential trading opportunities can be difficult. So it’s no wonder that options trading alerts are so popular: they’re an easy way to locate potentially profitable trades.

But don’t just go with the first service you find. Be sure to do your due diligence and check out the track record of the platform you’re considering. And even more important, consider if the options trading alert service aligns with your trading style and overall goals.

SPY shares were trading at $512.37 per share on Monday morning, down $0.48 (-0.09%). Year-to-date, SPY has gained 7.80%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Ryan Taylor

Ryan is a Property Financial Analyst and active real estate agent in Michigan. He has worked in the retirement industry for Voya Financial and Alerus Financial as a Retirement Analyst. Ryan holds a bachelor's degree in business from Ferris State University.

The post The 6 Best Options Trading Alerts in 2024 appeared first on StockNews.com