E*TRADE Financial Holdings, LLC today announced results from the most recent wave of StreetWise, the E*TRADE quarterly tracking study of experienced investors. Results indicate investor views across the market and the economy improved:

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210412005872/en/

(Graphic: Business Wire)

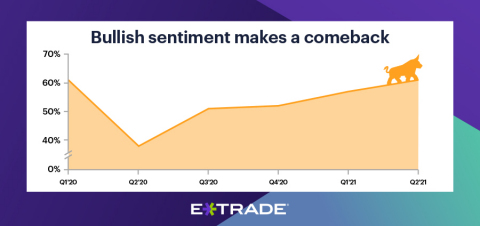

- Bullish sentiment rose. Bullish sentiment increased 4 percentage points since last quarter to 61%—matching pre-pandemic highs.

- And more believe the economy is in better shape. Nearly half of investors (46%) would give the US economy an A or B grade, increasing 15 percentage points from Q1.

- COVID concerns retreat while volatility concerns increase. Concern around coronavirus-related investment risk dropped 8 percentage points to 22%. Market volatility concerns increased 3 percentage points and now rank as the top risk to investor portfolios, at 26%.

- Yet the majority of investors believe we’re in a market bubble. Almost three out of four (69%) investors think we are fully or somewhat in a market bubble, up 3 percentage points from last quarter.

“Despite investor unease as interest rates shot higher over the last quarter, optimism grew as the market hit new all-time highs, vaccines increased, stimulus measures continued, and earnings estimates are high,” said Mike Loewengart, Managing Director of Investment Strategy at E*TRADE Financial. “But while the market is running hot, investors should keep a watchful eye on their portfolios to see if now is a good time to rebalance to ensure allocations remain mapped to their own goals and risk tolerances. Amid the increasingly maturing recovery we’ve seen these past few months, diversification is critical to ensure one’s portfolio continues to benefit as disparate parts of the market pick up steam or cool off.”

The survey explored investor views on sector opportunities for the second quarter of 2021:

- Health care. The sector remains number one in the eyes of investors, but interest decreased significantly—down 16 percentage points from last quarter—as vaccination accelerates.

- IT. Despite interest rate headwinds, the tech sector remains a perennial retail fan favorite, with over two out of five (41%) seeing opportunity in the sector.

- Energy. For the second consecutive quarter, the energy sector ranked third in investor interest (34%), as economies around the globe continue to reopen and recover.

E*TRADE aims to enhance the financial independence of traders and investors through a powerful digital offering and professional guidance. To learn more about E*TRADE’s trading and investing platforms and tools, visit etrade.com.

For useful trading and investing insights from E*TRADE, follow the company on Twitter, @ETRADE.

About the Survey

This wave of the survey was conducted from April 1 to April 12 of 2021 among an online US sample of 957 self-directed active investors who manage at least $10,000 in an online brokerage account. The survey has a margin of error of ±3.20 percent at the 95 percent confidence level. It was fielded and administered by Dynata. The panel is broken into thirds of active (trade more than once a week), swing (trade less than once a week but more than once a month), and passive (trade less than once a month). The panel is 60% male and 40% female, with an even distribution across online brokerages, geographic regions, and age bands.

About E*TRADE Financial Holdings, LLC and Important Notices

E*TRADE Financial Holdings, LLC and its subsidiaries provide financial services including brokerage and banking products and services to retail customers. Securities products and services are offered by E*TRADE Securities LLC (Member SIPC). Commodity futures and options on futures products and services are offered by E*TRADE Futures LLC (Member NFA). Managed Account Solutions are offered through E*TRADE Capital Management, LLC, a Registered Investment Adviser. Bank products and services are offered by E*TRADE Bank, and RIA custody solutions are offered by E*TRADE Savings Bank, both of which are national federal savings banks (Members FDIC). More information is available at www.etrade.com.

The information provided herein is for general informational purposes only and should not be considered investment advice. Past performance does not guarantee future results.

E*TRADE Financial, E*TRADE, and the E*TRADE logo are registered trademarks of E*TRADE Financial Holdings, LLC. ETFC-G

© 2021 E*TRADE Financial Holdings, LLC, a business of Morgan Stanley. All rights reserved.

E*TRADE Financial engages Dynata to program, field, and tabulate the study. Dynata provides digital research data and has locations in the Americas, Europe, the Middle East and Asia-Pacific. For more information, please go to www.dynata.com.

Referenced Data

When it comes to the current market, are you? | ||||||

Q2'21 | Q1'21 | Q4'20 | Q3'20 | Q2'20 | Q1'20 | |

Bullish | 61% | 57% | 52% | 51% | 38% | 61% |

Bearish | 39% | 43% | 48% | 49% | 62% | 39% |

What grade would you give the current state of the U.S. economy right now? | ||

Q2'21 | Q1'21 | |

Top 2 Box | 46% | 31% |

A | 14% | 5% |

B | 32% | 26% |

C | 38% | 43% |

D | 12% | 20% |

F | 4% | 6% |

Which of the following risks are you most concerned about when it comes to your portfolio? (Top Two) | ||

Q2'21 | Q1'21 | |

Market volatility | 26% | 23% |

Recession | 25% | 32% |

US trade tensions | 24% | 15% |

New presidential administration | 23% | 25% |

Coronavirus and other pandemic concerns | 22% | 30% |

Economic weakness abroad | 21% | 14% |

Fed monetary policy | 15% | 12% |

Inflation | 14% | 7% |

Gridlock in Washington | 14% | 20% |

Steepening yield curve | 6% | 6% |

Softening job market | 3% | 7% |

None of these | 2% | 3% |

Other | 1% | 2% |

Do you think current stock valuations would suggest that right now we are… | ||

Q2'21 | Q1'21 | |

Top 2 Box | 69% | 66% |

Fully in a market bubble | 22% | 15% |

In somewhat of a market bubble | 47% | 51% |

Approaching a market bubble | 22% | 26% |

Not close to a market bubble | 9% | 8% |

What industries do you think offer the most potential this quarter? (Top Three) | ||

Q2'21 | Q1'21 | |

Health care | 43% | 59% |

Information technology | 41% | 46% |

Energy | 34% | 30% |

Financials | 29% | 27% |

Real estate | 27% | 25% |

Consumer staples | 26% | 26% |

Industrials | 21% | 15% |

Communication services | 21% | 24% |

Consumer discretionary | 20% | 15% |

Utilities | 19% | 20% |

Materials | 19% | 15% |

ETFC

View source version on businesswire.com: https://www.businesswire.com/news/home/20210412005872/en/

Contacts:

646-521-4418

mediainq@etrade.com