Regional Management Corp. (NYSE: RM), a diversified consumer finance company, today provided an update on its business operations and financial position as of May 31, 2020.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20200603005891/en/

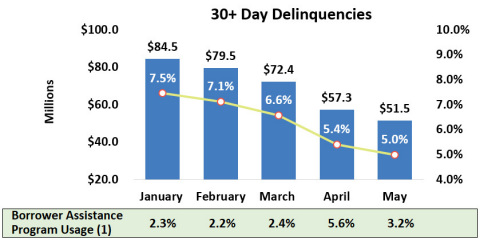

(1) Percentage of accounts that utilized borrower assistance programs during the month (Graphic: Business Wire)

Our top priority continues to be the health and well-being of our customers and team members as states relax their stay-at-home orders and reopen their economies. Our branch personnel and centralized collections team, aided by our digital capabilities, have provided largely uninterrupted support to our customers throughout this challenging time. With a proven operating model, a strong balance sheet, and ample liquidity, we remain well-positioned to further navigate through the current environment and continue to provide our customers with access to responsible and affordable credit solutions.

Stable Credit Profile

- Positive Credit Trends – Our borrower assistance programs and the government stimulus have served as an important bridge for our customers. Positive credit trends continued into May, with our 30+ day contractual delinquency rate decreasing to 5.0% as of May 31, 2020, an improvement of 40 basis points from April 30, 2020, 160 basis points from March 31, 2020, and 120 basis points from May 31, 2019. As of May 31, 2020, 30+ day contractual delinquency totaled $51.5 million, compared to $57.3 million as of April 30, 2020, $72.4 million as of March 31, 2020, and $60.2 million as of May 31, 2019. We expect that our 30+ day contractual delinquency rate will be below 6.0% as of June 30, 2020, and will increase throughout the balance of the year due to the impact of COVID-19 and normal seasonality. Given the recent low delinquency levels, we expect COVID-19 related credit losses to be pushed back to the fourth quarter of 2020 and into 2021. The overall level of losses will depend on, among other things, the pace at which state economies rebound, the unemployment rate, and whether federal and state governments enact further stimulus measures.

- Effective Borrower Assistance Programs – We leveraged our past experience in managing through natural disasters to design and implement programs that have been effective in supporting our customers throughout this crisis, while at the same time keeping them engaged and active in making payments on their accounts. Approximately 3.2% of the loans in our portfolio at the end of May had been deferred or renewed under our borrower assistance programs during the month, down from 5.6% in April. By comparison, for the 12 months prior to April 2020, the average monthly rate was 2.2%. We expect that our customers’ reliance on our borrower assistance programs will continue to decrease in June, though we remain well-positioned to continue operating these programs, as conditions warrant.

Rebounding Demand

- Branch Originations –We have continued to originate new branch loans with appropriately tightened lending criteria. Branch originations rebounded from $31.6 million in April 2020 to $48.3 million in May 2020. Across our footprint, we continue to see a gradual and ongoing improvement in branch loan applications and production from the low point in the second week of April, including in our largest markets of Texas and South Carolina, which were among the first states to reopen. May 2020 originations were down 56% compared to May 2019, while April 2020 originations were down 61% compared to April 2019.

- New Direct Mail and Digital Originations – In late April and early May, we reinitiated our direct mail campaigns and reopened our digital channels, focusing on higher credit quality segments as identified by our custom credit scorecards. Historically, these segments have provided attractive risk-adjusted returns that deliver positive contribution margin, even in challenging credit environments. In May, these channels produced $9.6 million of originations, up from $3.7 million in April.

- Favorable Geographic Concentration– We largely operate in states that have been among the least impacted by COVID-19 infections and among the most proactive in reopening their economies. Based on finance receivables distribution by state, the weighted-average unemployment rate in our footprint was 12.6% for the payroll period that included April 12th, compared to 14.7% nationally. We believe that the relative macroeconomic conditions in our states of operation favor a more rapid recovery in consumer demand compared to the broader United States economy. As state economies reopen and we gauge the results of our marketing programs, we expect to expand production in our branches and through our direct mail and digital marketing channels in a risk-appropriate manner. As of May 31, 2020, we had $1.03 billion in total finance receivables outstanding.

Customer-Centric Model

- Branch Operations – Our operations have been considered “essential services” under nearly all state mandates, and as a result, substantially all of our branches have remained open throughout the crisis, while adhering closely to CDC guidelines. At this time, branch personnel service our customers in-person by appointment, curbside, and by phone. We plan to allow walk-in traffic beginning in mid-June, with appropriate safety protocols.

- Remote Loan Closings – In May, we began rolling out a new remote loan closing process for our customers. We expect to make remote loan closing available to customers in all states over the next several weeks.

- Digital and Centralized Servicing – Our online portal enables our customers to view the status of their accounts and to initiate electronic payments (debit and ACH), and our centralized collections team has continued to support our branch servicing efforts. Our customers may call our branches or our toll-free telephone number to receive remote service by phone, including to apply for a loan, complete a loan deferral, and make an electronic payment.

- Customer Communications – We continue to communicate frequently with our customers by phone, text, and email to update them on the status of branch operations, highlight the availability of various electronic payment options, and inform them of new programs that may be available to help them.

Financially Sound

- Strong Balance Sheet –We continue to operate with a conservative leverage ratio. As of March 31, 2020, we had a funded debt-to-equity ratio of 3.1x, with $251.4 million in stockholders’ equity. Including our March 31, 2020 allowance for credit losses of $142.4 million, we have $393.8 million of capacity to absorb losses while still maintaining positive stockholders’ equity. In addition, we expect to generate further margin this year to absorb losses.

- Ample Liquidity – Our liquidity profile remains strong as we proactively diversified our funding over the past few years in anticipation of a shift in the credit cycle. As of May 31, 2020, we had $128 million of cash on hand and immediate availability to draw down cash from our revolving credit facilities, and $454 million of unused capacity on our various credit facilities (subject to the borrowing base). We do not believe that we will require access to the securitization market through 2021. In summary, we believe that we have more than adequate liquidity to support the fundamental operations of our business throughout the COVID-19 pandemic.

While we fully expect the pace of economic recovery to be uneven as states begin to reopen, we are confident that we will successfully manage through this period, address any challenges that arise, and position ourselves to take advantage of growth opportunities as the economy begins to stabilize and expand.

About Regional Management Corp.

Regional Management Corp. (NYSE: RM) is a diversified consumer finance company that provides attractive, easy-to-understand installment loan products primarily to customers with limited access to consumer credit from banks, thrifts, credit card companies, and other lenders. Regional Management operates under the name “Regional Finance” in 368 branch locations across 11 states in the Southeastern, Southwestern, Mid-Atlantic, and Midwestern United States, as of March 31, 2020. Most of its loan products are secured, and each is structured on a fixed rate, fixed term basis with fully amortizing equal monthly installment payments, repayable at any time without penalty. Regional Management sources loans through its multiple channel platform, which includes branches, centrally-managed direct mail campaigns, digital partners, retailers, and its consumer website. For more information, please visit www.RegionalManagement.com.

Forward-Looking Statements

This press release may contain various “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not statements of historical fact but instead represent Regional Management Corp.’s expectations or beliefs concerning future events. Forward-looking statements include, without limitation, statements concerning future plans, objectives, goals, projections, strategies, events, or performance, and underlying assumptions and other statements related thereto. Words such as “may,” “will,” “should,” “likely,” “anticipates,” “expects,” “intends,” “plans,” “projects,” “believes,” “estimates,” “outlook,” and similar expressions may be used to identify these forward-looking statements. Such forward-looking statements speak only as of the date on which they were made and are about matters that are inherently subject to risks and uncertainties, many of which are outside of the control of Regional Management. As a result, actual performance and results may differ materially from those contemplated by these forward-looking statements. Therefore, investors should not place undue reliance on forward-looking statements.

Factors that could cause actual results or performance to differ from the expectations expressed or implied in forward-looking statements include, but are not limited to, the following: changes in general economic conditions, including levels of unemployment and bankruptcies; the impact of the recent outbreak of a novel coronavirus (COVID-19), including on Regional Management’s access to liquidity and the credit risk of Regional Management’s finance receivable portfolio; risks associated with Regional Management’s ability to timely and effectively implement, transition to, and maintain the necessary information technology systems, infrastructure, processes, and controls to support its operations and initiatives; risks associated with Regional Management’s loan origination and servicing software system, including the risk of prolonged system outages; risks related to opening new branches, including the ability or inability to open new branches as planned; risks inherent in making loans, including credit risk, repayment risk, and value of collateral, which risks may increase in light of adverse or recessionary economic conditions; risks associated with the implementation of new underwriting models and processes, including as to the effectiveness of new custom scorecards; risks relating to Regional Management’s asset-backed securitization transactions; changes in interest rates; the risk that Regional Management’s existing sources of liquidity become insufficient to satisfy its needs or that its access to these sources becomes unexpectedly restricted; changes in federal, state, or local laws, regulations, or regulatory policies and practices, and risks associated with the manner in which laws and regulations are interpreted, implemented, and enforced; changes in accounting standards, rules, and interpretations, and the failure of related assumptions and estimates, including those associated with the implementation of current expected credit loss (CECL) accounting; the impact of changes in tax laws, guidance, and interpretations; the timing and amount of revenues that may be recognized by Regional Management; changes in current revenue and expense trends (including trends affecting delinquencies and credit losses); changes in Regional Management’s markets and general changes in the economy (particularly in the markets served by Regional Management); the impact of any civil unrest or disturbances within Regional Management’s markets; changes in the competitive environment in which Regional Management operates or a decrease in the demand for its products; risks related to acquisitions; changes in operating and administrative expenses; and the departure, transition, or replacement of key personnel. The COVID-19 pandemic may also magnify many of these risks and uncertainties.

The foregoing factors and others are discussed in greater detail in Regional Management’s filings with the Securities and Exchange Commission. Regional Management will not update or revise forward-looking statements to reflect events or circumstances after the date of this press release or to reflect the occurrence of unanticipated events or the non-occurrence of anticipated events, whether as a result of new information, future developments, or otherwise, except as required by law. Regional Management is not responsible for changes made to this document by wire services or Internet services.

View source version on businesswire.com: https://www.businesswire.com/news/home/20200603005891/en/

Contacts:

Garrett Edson, (203) 682-8331

investor.relations@regionalmanagement.com