Earnings results often indicate what direction a company will take in the months ahead. With Q3 behind us, let’s have a look at El Pollo Loco (NASDAQ:LOCO) and its peers.

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

The 14 traditional fast food stocks we track reported a mixed Q3. As a group, revenues were in line with analysts’ consensus estimates.

In light of this news, share prices of the companies have held steady as they are up 2.1% on average since the latest earnings results.

El Pollo Loco (NASDAQ:LOCO)

With a name that translates into ‘The Crazy Chicken’, El Pollo Loco (NASDAQ:LOCO) is a fast food chain known for its citrus-marinated, fire-grilled chicken recipe that hails from the coastal town of Sinaloa, Mexico.

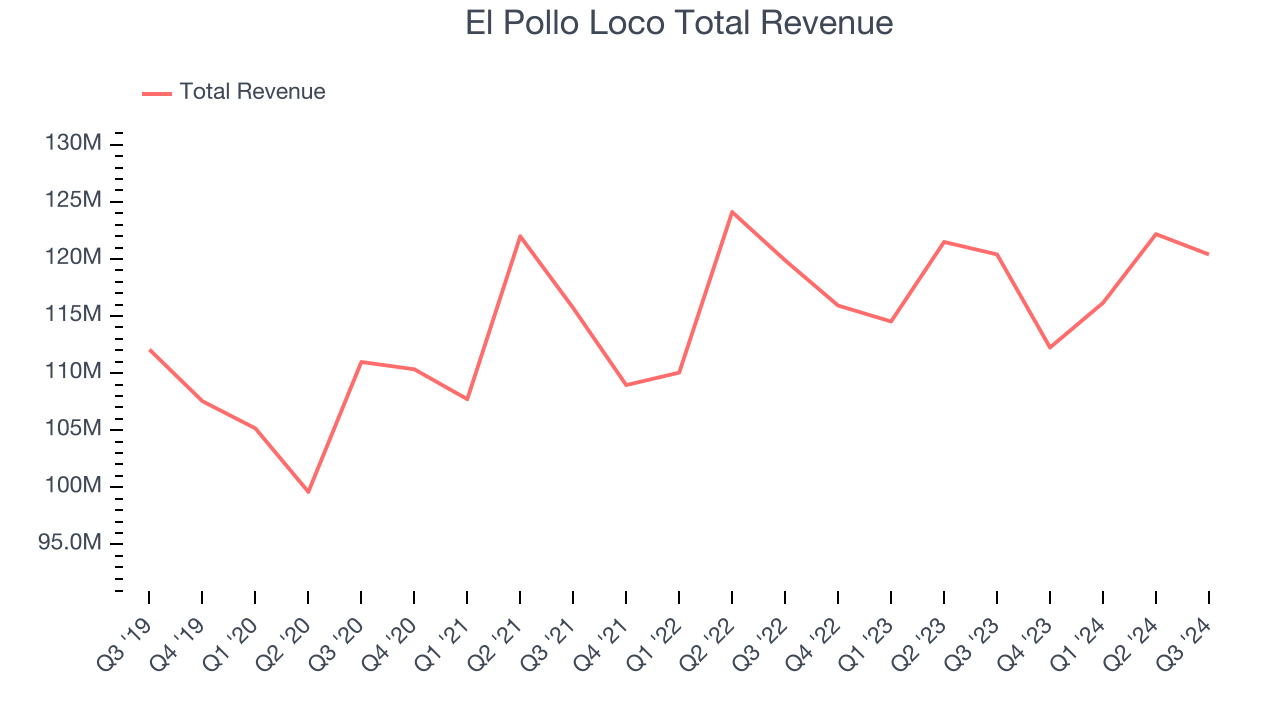

El Pollo Loco reported revenues of $120.4 million, flat year on year. This print fell short of analysts’ expectations by 0.5%, but it was still a strong quarter for the company with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ EPS estimates.

Liz Williams, Chief Executive Officer of El Pollo Loco Holdings, Inc., stated, “Our third quarter results reflect yet another step toward capturing the opportunity ahead of us to become the national fire-grilled chicken brand. More specifically, we drove top-line growth through a 2.7% increase in system-wide comparable sales; expanded restaurant-level margins by 230 basis points year-over-year to 16.7%; and continue to make great progress on reducing the cost of our prototype to stimulate future unit growth. As we look ahead, we are pleased with what we have accomplished thus far to develop a strong foundation, and we are well positioned to ignite further growth in 2025 and beyond.”

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $12.13.

Is now the time to buy El Pollo Loco? Access our full analysis of the earnings results here, it’s free.

Best Q3: Dutch Bros (NYSE:BROS)

Started in 1992 by two brothers as a single pushcart, Dutch Bros (NYSE:BROS) is a dynamic coffee chain that’s captured the hearts of coffee enthusiasts across the United States.

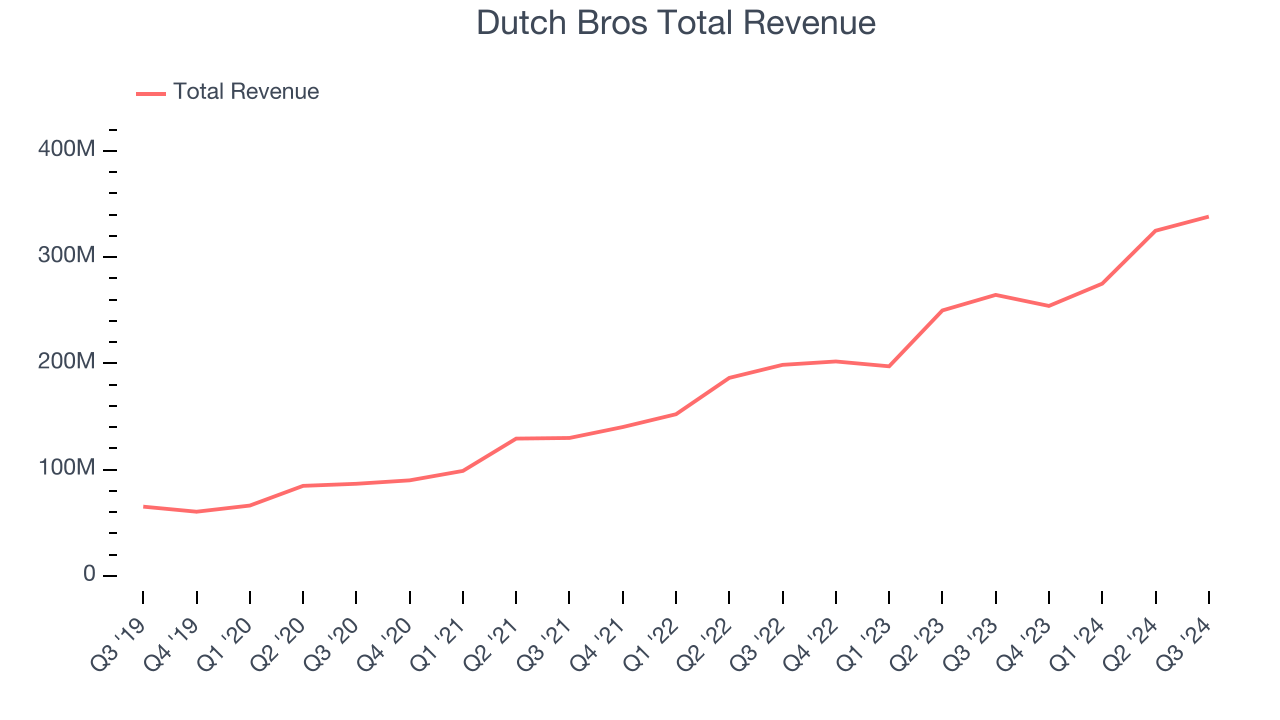

Dutch Bros reported revenues of $338.2 million, up 27.9% year on year, outperforming analysts’ expectations by 4.1%. The business had a stunning quarter with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ same-store sales estimates.

Dutch Bros achieved the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 56.5% since reporting. It currently trades at $54.65.

Is now the time to buy Dutch Bros? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Krispy Kreme (NASDAQ:DNUT)

Famous for its Original Glazed doughnuts and parent company of Insomnia Cookies, Krispy Kreme (NASDAQ:DNUT) is one of the most beloved and well-known fast-food chains in the world.

Krispy Kreme reported revenues of $379.9 million, down 6.8% year on year, in line with analysts’ expectations. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

Krispy Kreme delivered the slowest revenue growth and weakest full-year guidance update in the group. As expected, the stock is down 12.2% since the results and currently trades at $10.91.

Read our full analysis of Krispy Kreme’s results here.

Jack in the Box (NASDAQ:JACK)

Delighting customers since its inception in 1951, Jack in the Box (NASDAQ:JACK) is a distinctive fast-food chain known for its bold flavors, innovative menu items, and quirky marketing.

Jack in the Box reported revenues of $349.3 million, down 6.2% year on year. This number missed analysts’ expectations by 2.1%. Overall, it was a softer quarter as it also recorded full-year EPS guidance missing analysts’ expectations significantly and a slight miss of analysts’ same-store sales estimates.

The stock is up 9.6% since reporting and currently trades at $50.

Read our full, actionable report on Jack in the Box here, it’s free.

Restaurant Brands (NYSE:QSR)

Formed through a strategic merger, Restaurant Brands International (NYSE:QSR) is a multinational corporation that owns three iconic fast-food chains: Burger King, Tim Hortons, and Popeyes.

Restaurant Brands reported revenues of $2.29 billion, up 24.7% year on year. This number missed analysts’ expectations by 2.7%. It was a slower quarter as it also produced a miss of analysts’ EPS estimates.

The stock is flat since reporting and currently trades at $70.40.

Read our full, actionable report on Restaurant Brands here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), has fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty heading into 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.