What a brutal six months it’s been for Medifast. The stock has dropped 20.6% and now trades at $19.84, rattling many shareholders. This may have investors wondering how to approach the situation.

Is now the time to buy Medifast, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.Despite the more favorable entry price, we're cautious about Medifast. Here are three reasons why MED doesn't excite us and a stock we'd rather own.

Why Do We Think Medifast Will Underperform?

Known for its Optavia program that combines portion-controlled meal replacements with coaching, Medifast (NYSE:MED) has a broad product portfolio of bars, snacks, drinks, and desserts for those looking to lose weight or consume healthier foods.

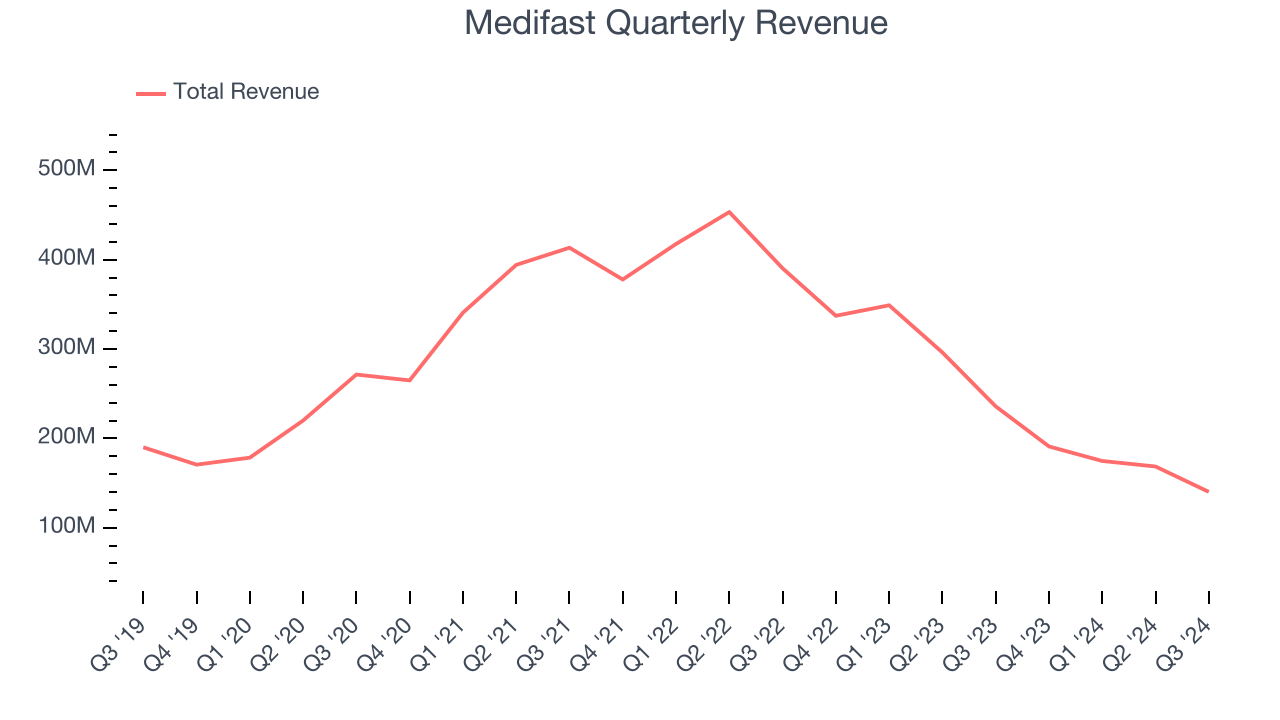

1. Revenue Spiraling Downwards

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, Medifast’s demand was weak and its revenue declined by 21.9% per year. This fell short of our benchmarks and is a sign of poor business quality.

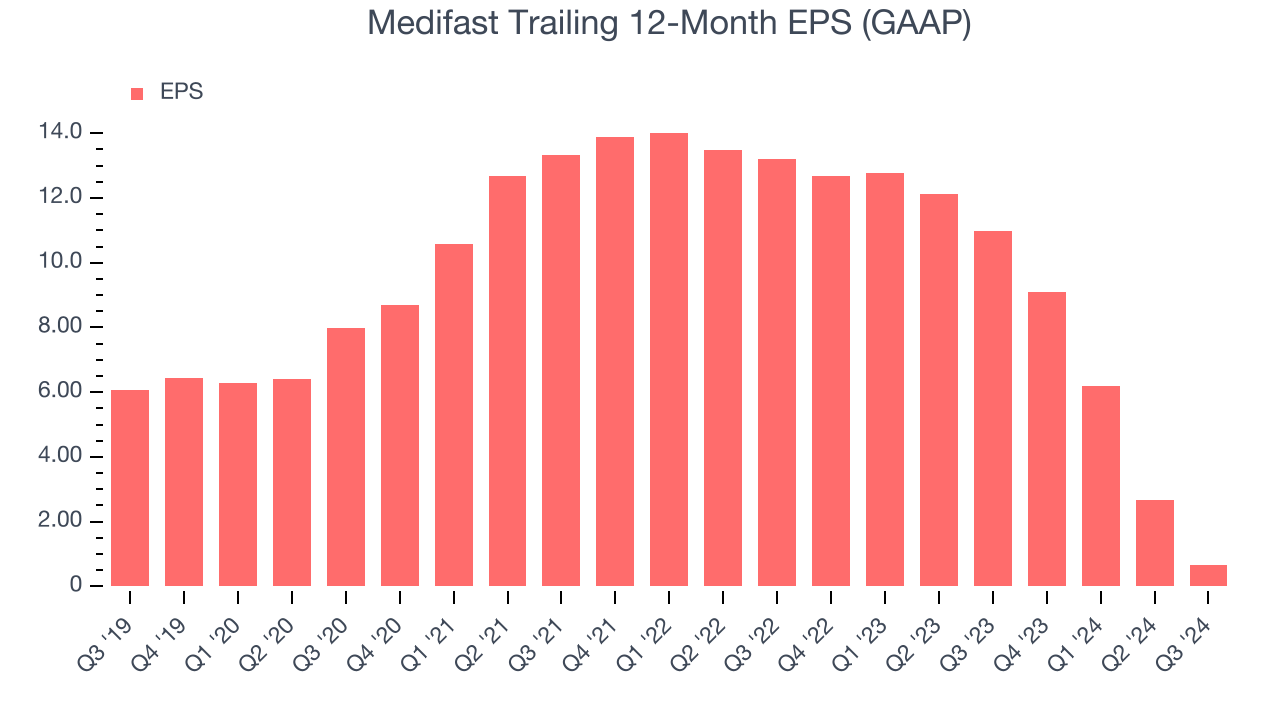

2. EPS Trending Down

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Medifast, its EPS declined by more than its revenue over the last three years, dropping 63.3% annually. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Final Judgment

Medifast doesn’t pass our quality test. Following the recent decline, the stock trades at 40.1x forward price-to-earnings (or $19.84 per share). This valuation tells us a lot of optimism is priced in - we think there are better stocks to buy right now. We’d suggest looking at Cloudflare, one of our top software picks that could be a home run with edge computing.

Stocks We Like More Than Medifast

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market to cap off the year - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.