Over the last six months, ICF’s shares have sunk to $118.90, producing a disappointing 18.8% loss - a stark contrast to the S&P 500’s 9.7% gain. This might have investors contemplating their next move.

Is now the time to buy ICF, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.Even though the stock has become cheaper, we're cautious about ICF. Here are three reasons why we avoid ICFI and a stock we'd rather own.

Why Is ICF Not Exciting?

Originally founded as Inner City Fund, ICF International (NASDAQ:ICFI) delivers consulting and technology services in health, environment, and infrastructure.

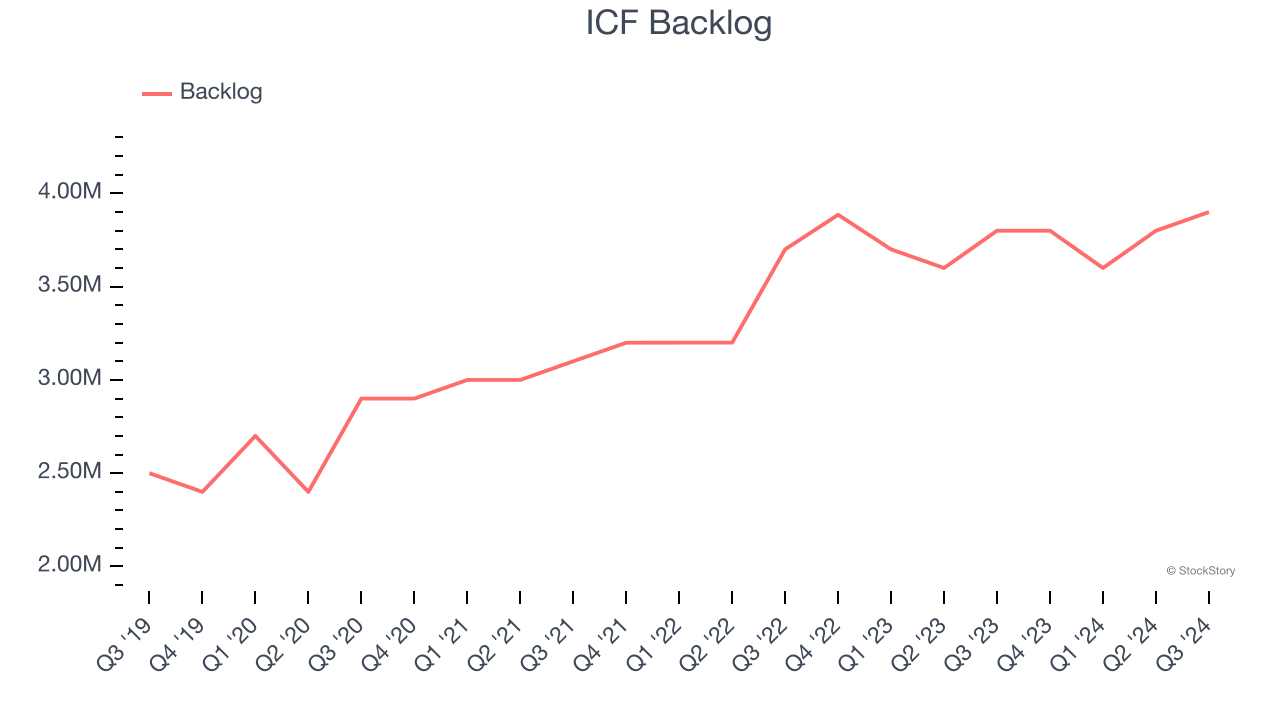

1. Weak Backlog Growth Points to Soft Demand

We can better understand Defense Contractors companies by analyzing their backlog. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into ICF’s future revenue streams.

ICF’s backlog came in at $3.9 million in the latest quarter, and over the last two years, its year-on-year growth averaged 6.9%. This performance slightly lagged the sector and suggests that increasing competition is causing challenges in winning new orders.

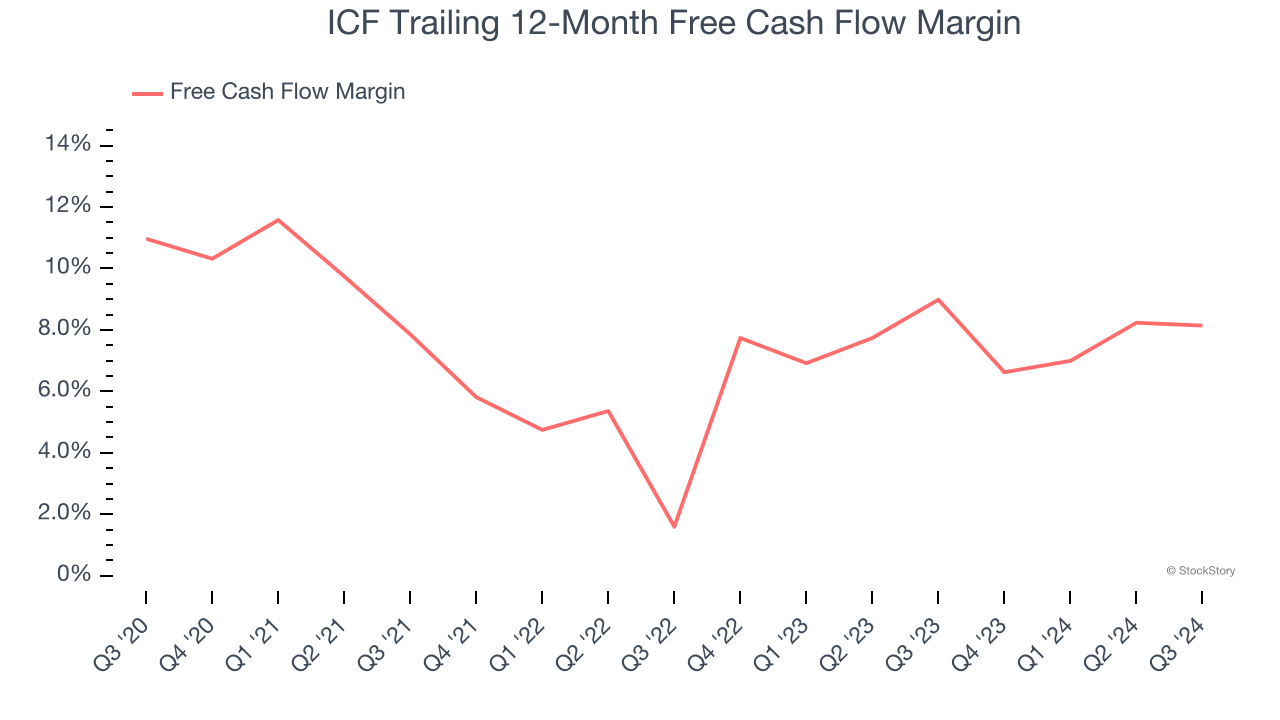

2. Free Cash Flow Margin Dropping

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, ICF’s margin dropped by 2.8 percentage points over the last five years. If its declines continue, it could signal higher capital intensity. ICF’s free cash flow margin for the trailing 12 months was 8.1%.

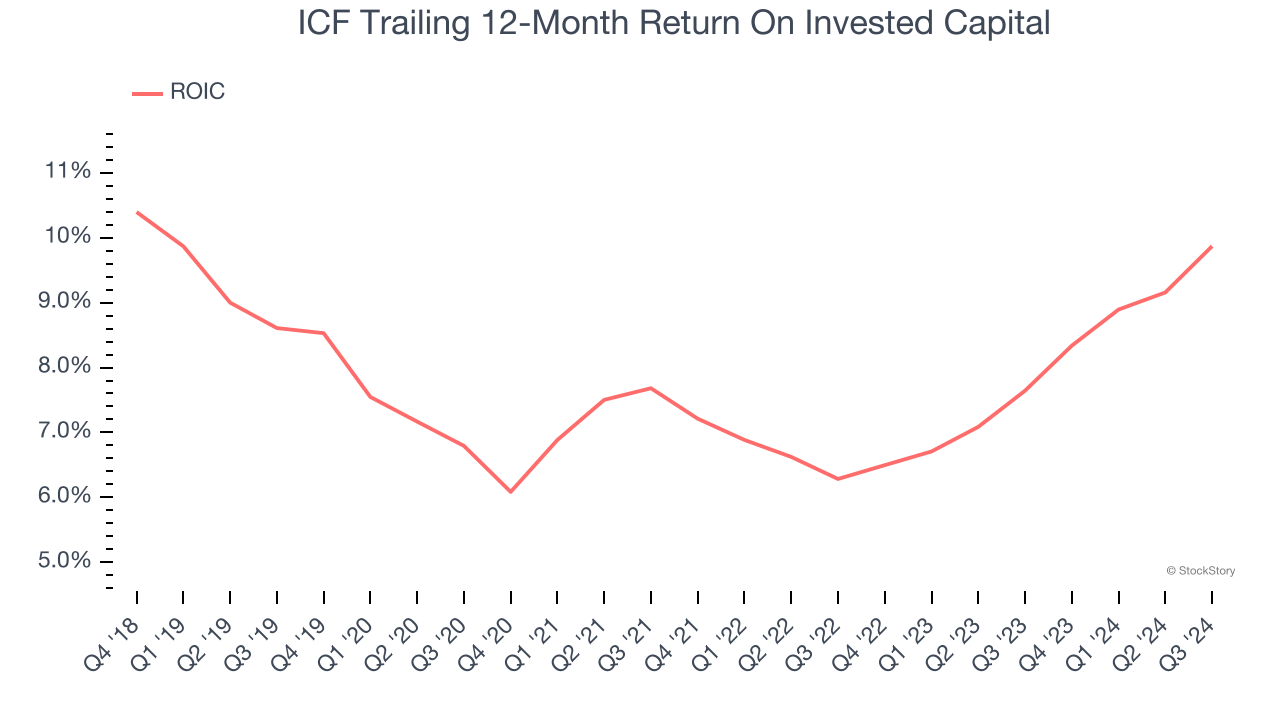

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

ICF historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 7.7%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

Final Judgment

ICF isn’t a terrible business, but it doesn’t pass our bar. After the recent drawdown, the stock trades at 15.9× forward price-to-earnings (or $118.90 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better stocks to buy right now. We’d recommend looking at Microsoft, the most dominant software business in the world.

Stocks We Would Buy Instead of ICF

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.