AI lending platform Upstart (NASDAQ:UPST) reported Q3 CY2024 results beating Wall Street’s revenue expectations, with sales up 20.5% year on year to $162.1 million. On top of that, next quarter’s revenue guidance ($180 million at the midpoint) was surprisingly good and 10.9% above what analysts were expecting. Its non-GAAP loss of $0.06 per share was also 59.1% above analysts’ consensus estimates.

Is now the time to buy Upstart? Find out by accessing our full research report, it’s free.

Upstart (UPST) Q3 CY2024 Highlights:

- Revenue: $162.1 million vs analyst estimates of $150.2 million (7.9% beat)

- Adjusted EPS: -$0.06 vs analyst estimates of -$0.15

- Adjusted Operating Income: -$45.15 million vs analyst estimates of -$49.42 million (8.6% beat)

- Revenue Guidance for Q4 CY2024 is $180 million at the midpoint, above analyst estimates of $162.3 million

- Gross Margin (GAAP): 60%, down from 72.6% in the same quarter last year

- Operating Margin: -27.8%, up from -32.6% in the same quarter last year

- Free Cash Flow Margin: 109%, up from 26.9% in the previous quarter

- Market Capitalization: $4.83 billion

“With 43% sequential growth in lending volume and a return to positive adjusted EBITDA, we continue to strengthen Upstart’s position as the fintech leader in artificial intelligence,” said Dave Girouard, co-founder and CEO of Upstart.

Company Overview

Founded by the former head of Google's enterprise business Dave Girouard, Upstart (NASDAQ:UPST) is an AI-powered lending platform that helps banks better evaluate the risk of lending money to a person and provide loans to more customers.

Lending Software

Businesses have come to use data driven insights to stratify their customers into more granular buckets that enable more personalized (and profitable) offerings. Lending software is a prime example of fintech democratizing access to loans in a still-profitable manner for financial institutions.

Sales Growth

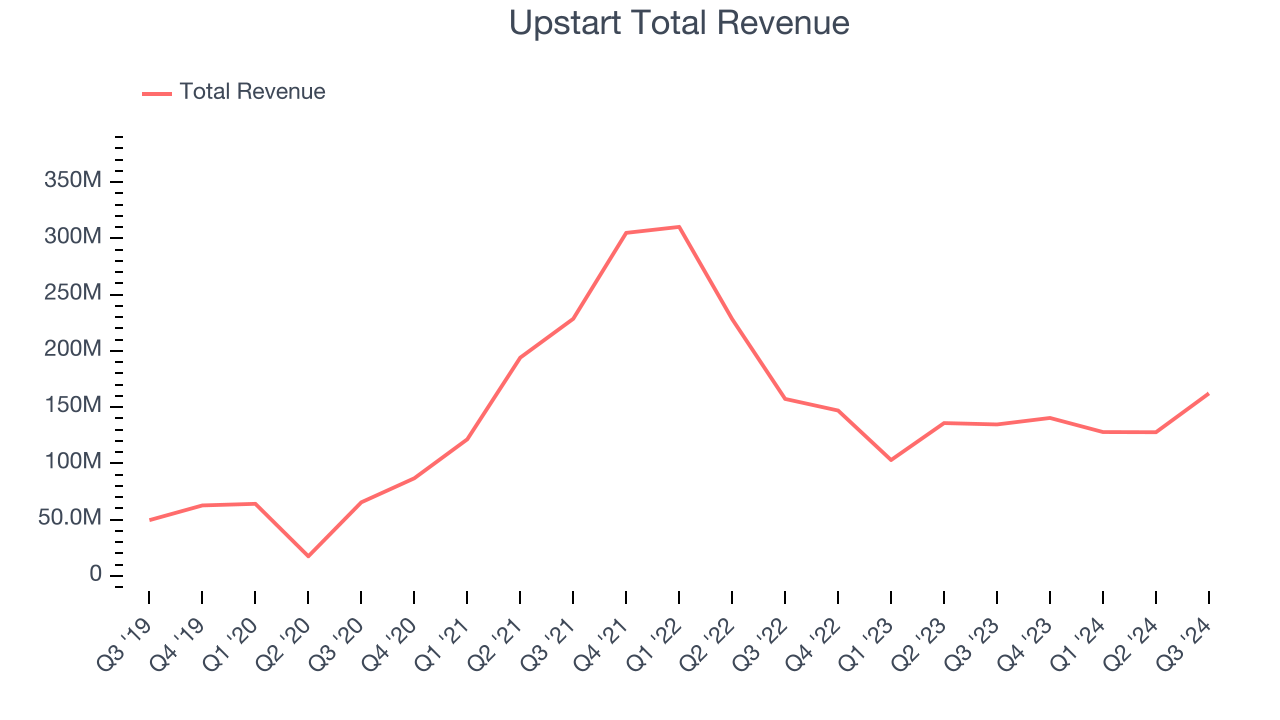

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years. Over the last three years, Upstart’s revenue declined by 4% per year. This shows demand was weak, a rough starting point for our analysis.

This quarter, Upstart reported robust year-on-year revenue growth of 20.5%, and its $162.1 million of revenue topped Wall Street estimates by 7.9%. Management is currently guiding for a 28.3% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 24% over the next 12 months, an acceleration versus the last three years. This projection is commendable and shows the market believes its newer products and services will fuel higher growth rates.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

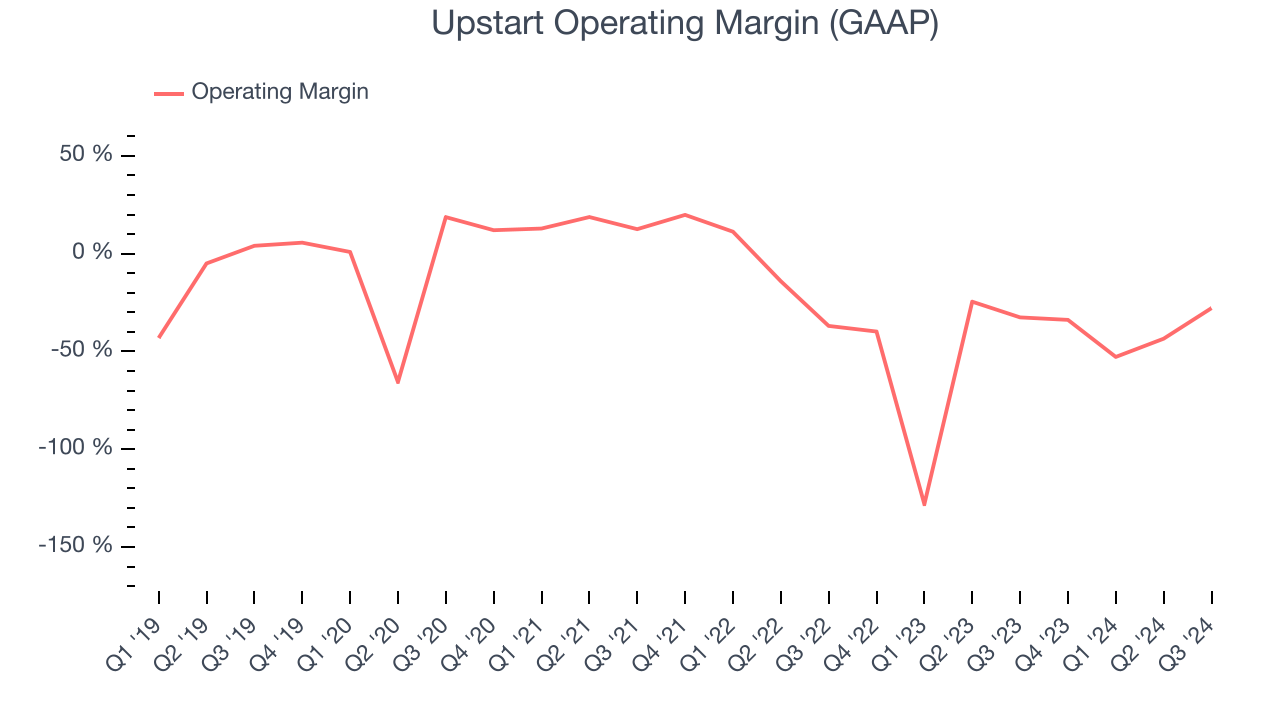

Upstart’s expensive cost structure has contributed to an average operating margin of negative 38.6% over the last year. Unprofitable software companies require extra attention because they spend loads of money to capture market share. As seen in its revenue, this strategy hasn’t worked so far, and it’s unclear what would happen if Upstart reeled back its investments.

On the plus side, Upstart’s annual operating margin rose by 12.8 percentage points over the last year. Still, it will take much more for the company to reach long-term profitability.

Upstart’s operating margin was negative 27.8% this quarter. The company's lacking profits are certainly concerning.

Customer Acquisition Efficiency

Customer acquisition cost (CAC) payback represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for marketing and sales investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

It’s very expensive for Upstart to acquire new customers as its CAC payback period checked in at -227 months this quarter. The company’s inefficiency indicates a highly competitive environment with little differentiation between Upstart’s products and its peers.

Key Takeaways from Upstart’s Q3 Results

We were impressed by Upstart’s revenue guidance and rosy outlook for next quarter, which blew past analysts’ expectations. We were also excited its revenue outperformed Wall Street’s estimates. On the other hand, its gross margin declined. Zooming out, we think this was a good quarter with some key areas of upside. The stock traded up 12% to $62.10 immediately following the results.

Upstart had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.