Data analytics software provider Amplitude (NASDAQ:AMPL) beat Wall Street’s revenue expectations in Q3 CY2024, with sales up 6.5% year on year to $75.22 million. Guidance for next quarter’s revenue was better than expected at $76.5 million at the midpoint, 1% above analysts’ estimates. Its non-GAAP profit of $0.03 per share was also 281% above analysts’ consensus estimates.

Is now the time to buy Amplitude? Find out by accessing our full research report, it’s free.

Amplitude (AMPL) Q3 CY2024 Highlights:

- Revenue: $75.22 million vs analyst estimates of $74.12 million (1.5% beat)

- Adjusted EPS: $0.03 vs analyst estimates of $0.01 ($0.02 beat)

- Adjusted Operating Income: $1.57 million vs analyst estimates of -$1.83 million (186% beat)

- Revenue Guidance for Q4 CY2024 is $76.5 million at the midpoint, above analyst estimates of $75.73 million

- Gross Margin (GAAP): 75.1%, in line with the same quarter last year

- Operating Margin: -26.6%, up from -29.6% in the same quarter last year

- Free Cash Flow Margin: 6%, down from 9.3% in the previous quarter

- Annual Recurring Revenue: $298 million at quarter end, up 9.2% year on year

- Customers: 3,486, up from 3,224 in the previous quarter

- Market Capitalization: $1.23 billion

"We are on the path to reaccelerating growth," said Spenser Skates, CEO and co-founder of Amplitude.

Company Overview

Born out of a failed voice recognition startup by founder Spenser Skates, Amplitude (NASDAQ:AMPL) is data analytics software helping companies improve and optimize their digital products.

Data Analytics

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the siloed data.

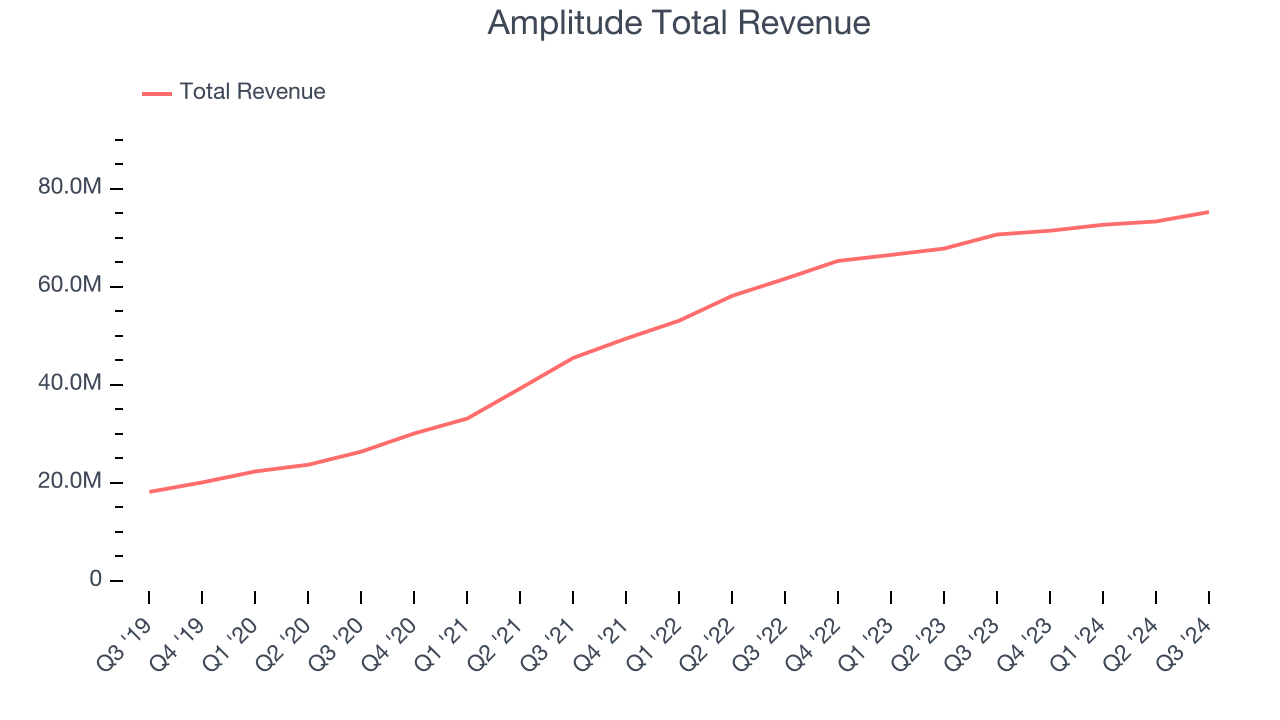

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, Amplitude grew its sales at a solid 25.5% compounded annual growth rate. This is a useful starting point for our analysis.

This quarter, Amplitude reported year-on-year revenue growth of 6.5%, and its $75.22 million of revenue exceeded Wall Street’s estimates by 1.5%. Management is currently guiding for a 7.1% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6.9% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and illustrates the market believes its products and services will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

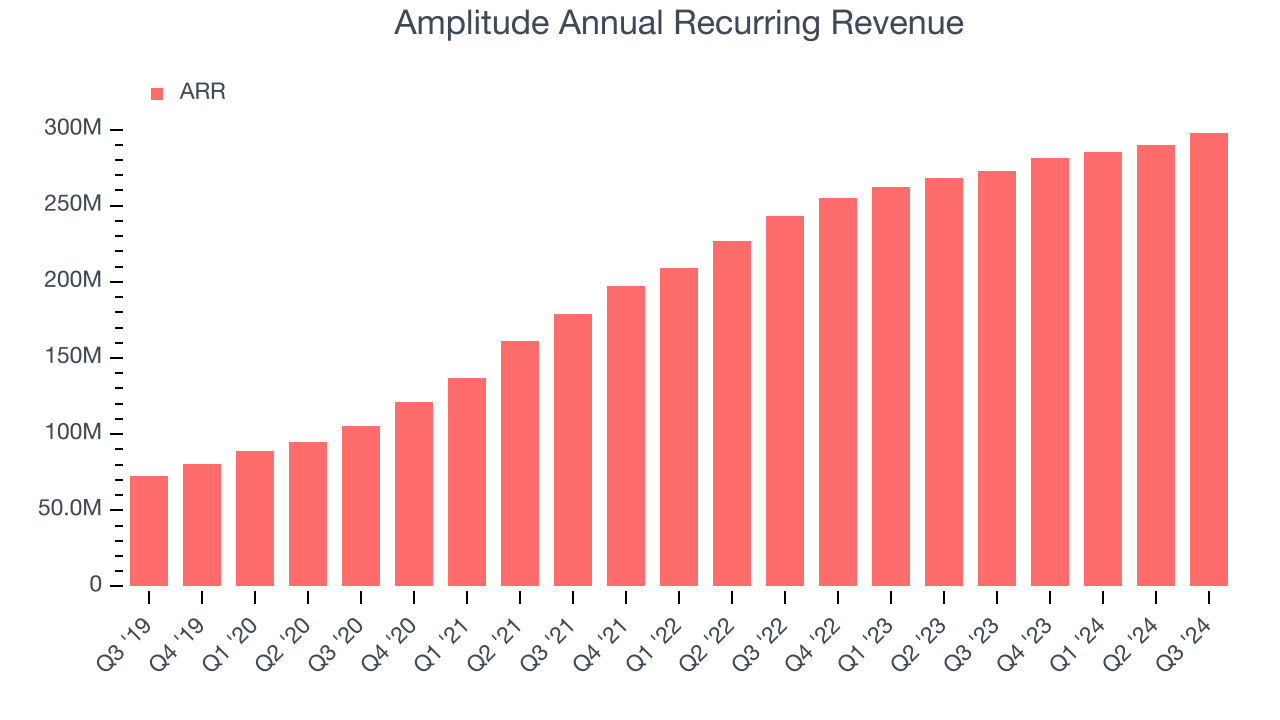

Annual Recurring Revenue

Investors interested in Amplitude should track its annual recurring revenue (ARR) in addition to reported revenue. While reported revenue for a SaaS company can include low-margin items like implementation fees, ARR is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Over the last year, Amplitude’s ARR growth has slightly underperformed the sector, averaging 9.1% year-on-year increases and coming in at $298 million in the latest quarter. This performance mirrored its revenue and suggests there may be increasing competition that is causing challenges in securing longer-term commitments.

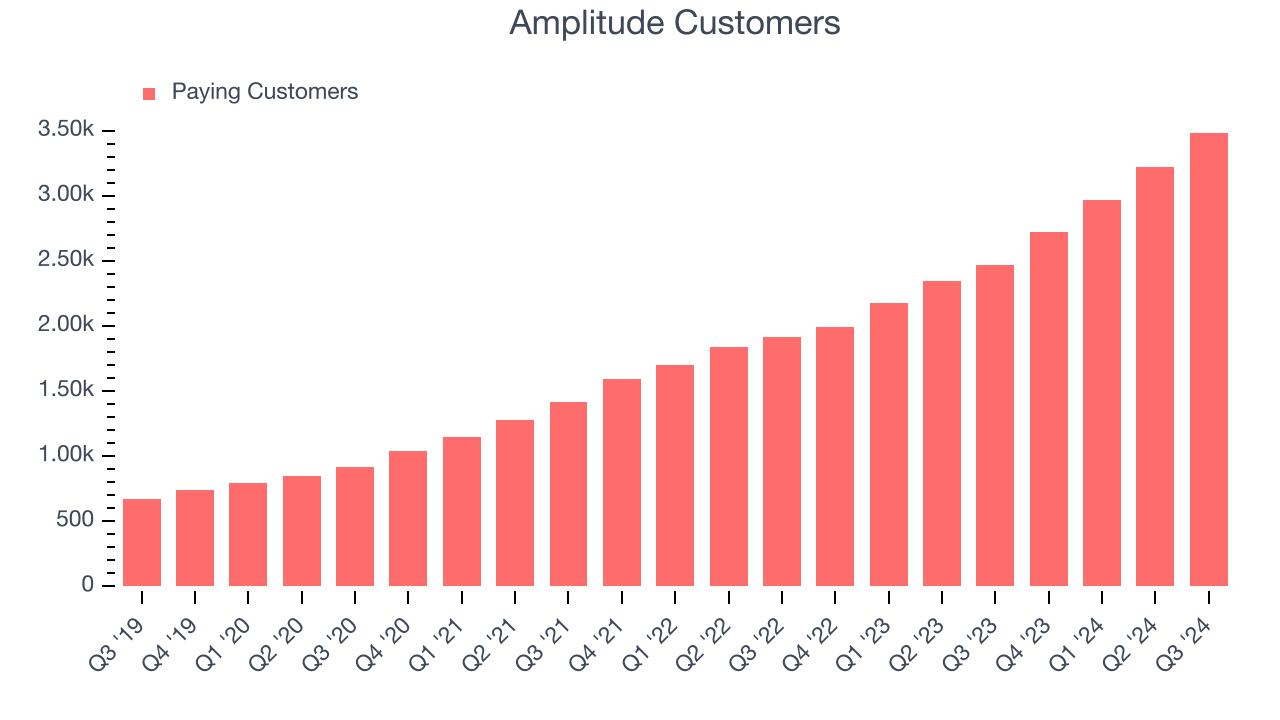

Customer Growth

Amplitude reported 3,486 customers at the end of the quarter, an increase of 262 from the previous quarter. That’s roughly the same customer growth as we observed last quarter and quite a bit above what we’ve typically seen over the last year, confirming that the company is sustaining a good sales pace.

Key Takeaways from Amplitude’s Q3 Results

It was good to see Amplitude beat analysts’ ARR (annual recurring revenue) expectations this quarter. We were also glad its gross margin improved. Overall, this quarter had some key positives. The stock remained flat at $10.55 immediately following the results.

So should you invest in Amplitude right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.