Digital casino game platform PlayStudios (NASDAQ:MYPS) reported Q3 CY2024 results topping the market’s revenue expectations, but sales fell 6.1% year on year to $71.23 million. The company expects the full year’s revenue to be around $290 million, close to analysts’ estimates. Its GAAP loss of $0.02 per share was 6.3% below analysts’ consensus estimates.

Is now the time to buy PlayStudios? Find out by accessing our full research report, it’s free.

PlayStudios (MYPS) Q3 CY2024 Highlights:

- Revenue: $71.23 million vs analyst estimates of $68.58 million (3.9% beat)

- EPS: -$0.02 vs analyst expectations of -$0.02 (in line)

- EBITDA: $14.62 million vs analyst estimates of $12.95 million (12.9% beat)

- The company reconfirmed its revenue guidance for the full year of $290 million at the midpoint

- EBITDA guidance for the full year is $57.5 million at the midpoint, above analyst estimates of $56.88 million

- Gross Margin (GAAP): 75%, up from 73.8% in the same quarter last year

- Operating Margin: -6.7%

- EBITDA Margin: 20.5%, up from 17.8% in the same quarter last year

- Monthly Active Users: 2.96 million, down 10.75 million year on year

- Market Capitalization: $170.8 million

Andrew Pascal, Chairman and Chief Executive Officer of PLAYSTUDIOS, commented, “Despite continued industry pressures, revenues and consolidated AEBITDA came in above consensus expectations this quarter. AEBITDA margins increased to 20.5% and we believe further gains are achievable. We made progress on our many strategic initiatives this quarter including raising the monetization of our games, expanding the Tetris Brand, a full integration of playAWARDS, furthering our DTC initiative, and evaluating new growth opportunities.”

Company Overview

Founded by a team of former gaming industry executives, PlayStudios (NASDAQ:MYPS) offers free-to-play digital casino games.

Gaming Solutions

Gaming solution companies operate in a dynamic and evolving market, and the digital transformation of the gaming industry presents significant opportunities for innovation and growth, whether it be immersive slot machine terminals or mobile sports betting. However, the gaming solution industry is not without its challenges. Regulatory compliance is a crucial consideration as companies must navigate a complex and often fragmented regulatory landscape across different jurisdictions. Changes in regulations can impact product offerings, operational practices, and market access, requiring companies to maintain flexibility and adaptability in their business strategies. Additionally, the competitive nature of the industry necessitates continuous investment in research and development to stay ahead of competitors and meet evolving consumer demands.

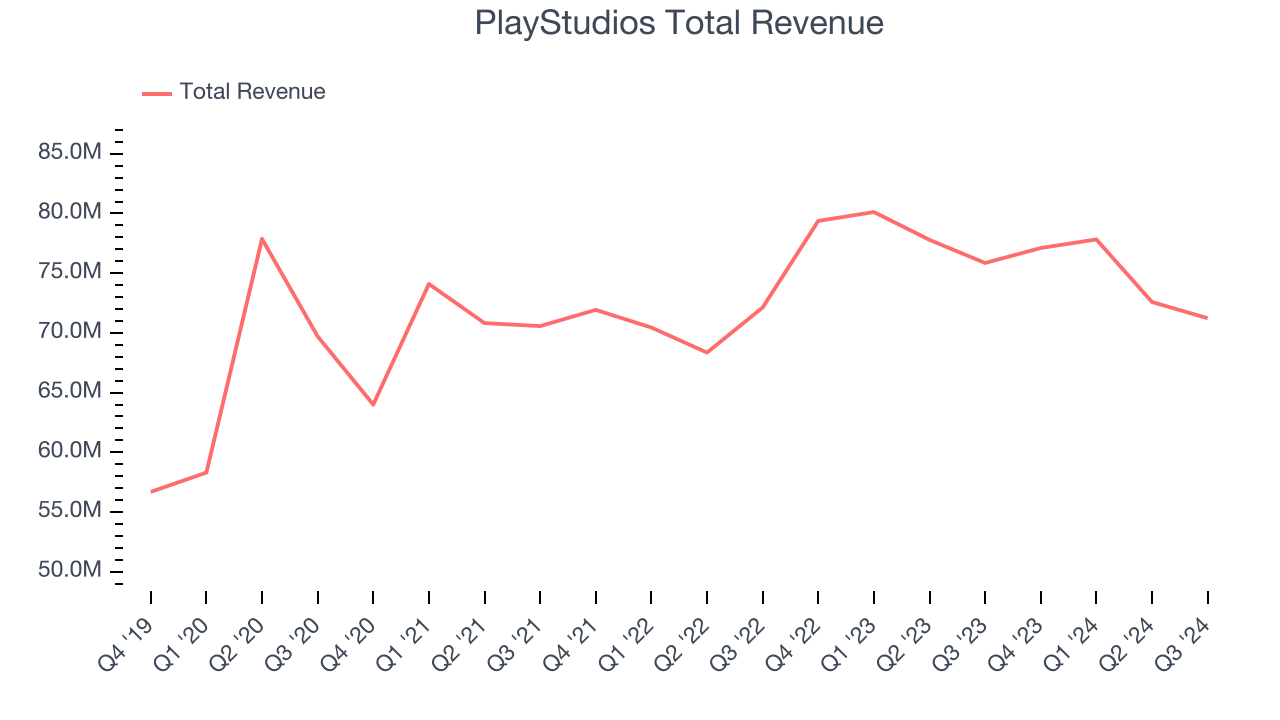

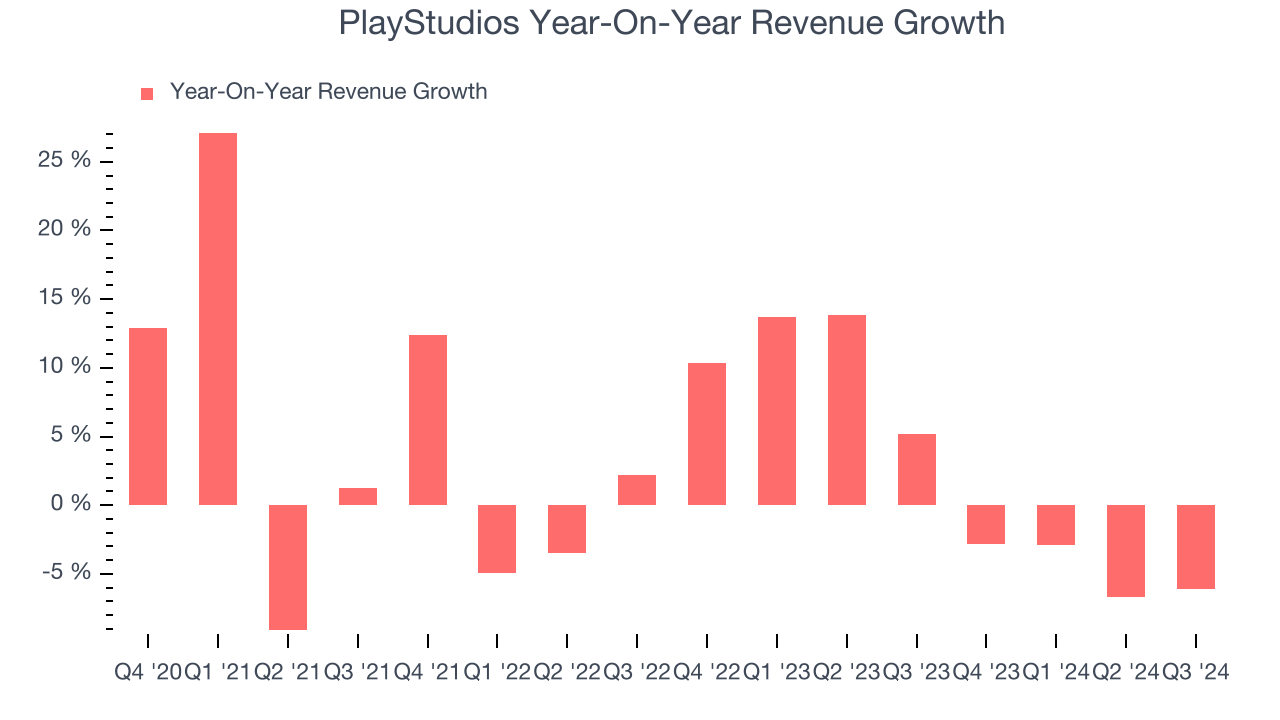

Sales Growth

Examining a company’s long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, PlayStudios’s sales grew at a sluggish 3.3% compounded annual growth rate over the last four years. This shows it failed to expand in any major way, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or emerging trend. PlayStudios’s annualized revenue growth of 2.8% over the last two years aligns with its four-year trend, suggesting its demand was consistently weak.

This quarter, PlayStudios’s revenue fell 6.1% year on year to $71.23 million but beat Wall Street’s estimates by 3.9%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and shows the market believes its products and services will face some demand challenges.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

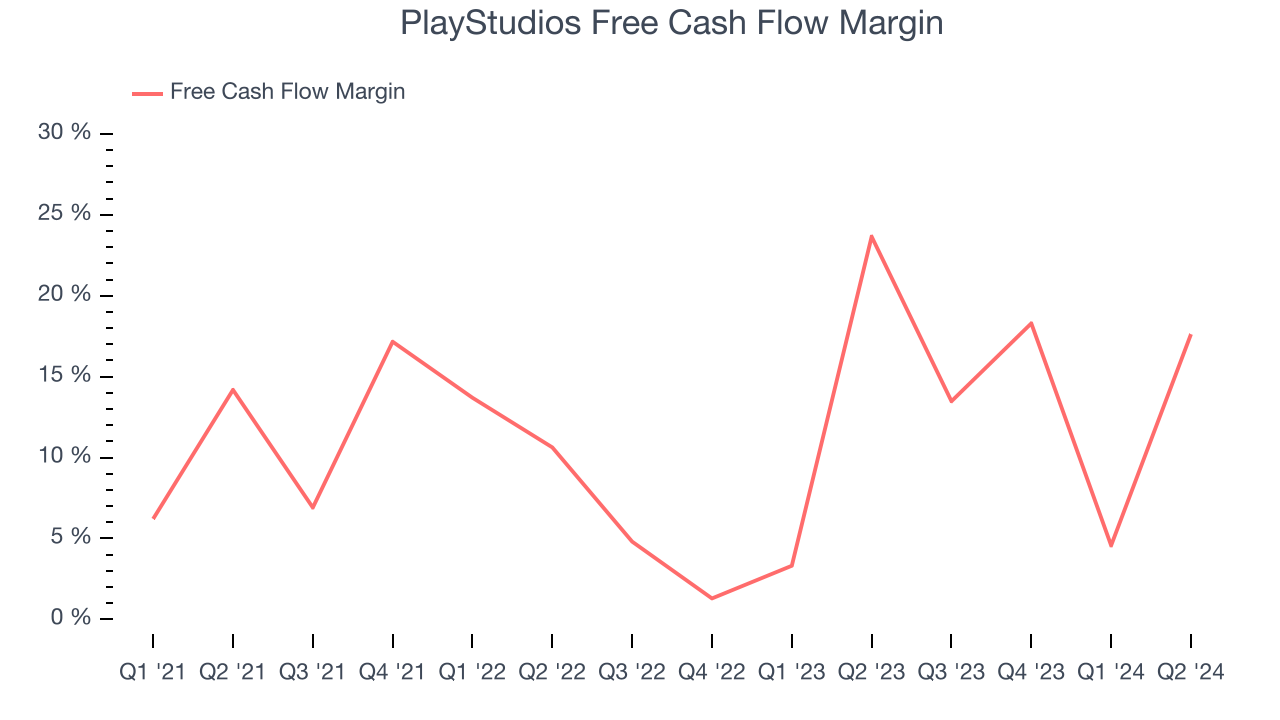

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

PlayStudios has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 11.6% over the last two years, slightly better than the broader consumer discretionary sector.

Key Takeaways from PlayStudios’s Q3 Results

We enjoyed seeing PlayStudios exceed analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates. On the other hand, its EPS missed. Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes. The market seemed to focus on the negatives, and the stock traded down 4.3% to $1.32 immediately after reporting.

So do we think PlayStudios is an attractive buy at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.