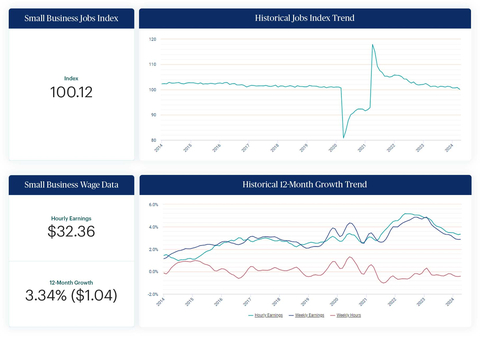

According to the Paychex Small Business Employment Watch, hourly earnings growth increased slightly to 3.34%, ending a nearly two-year trend of deceleration, and job growth slowed in April. U.S. small businesses with fewer than 50 employees continued to add jobs but at a slower pace with the Small Business Jobs Index standing at 100.12. The growth in weekly hours worked for employees also slowed for the 13th consecutive month, down -0.41% in April.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240430349010/en/

Small businesses continued to add jobs in April but at a slower pace. Meanwhile, hourly earnings ticked up to 3.34% for the month, ending a nearly two-year trend of deceleration. (Graphic: Business Wire)

“Our jobs index remains over 100, indicating continued year-over-year employment growth, yet the pace of growth has slowed,” said John Gibson, Paychex president and CEO. “Demand for qualified workers continues to outweigh supply, which may be forcing employers to consider offering higher wages to attract and retain talent.”

“Hourly earnings growth increased to 3.34% in April, ending a decline that began in mid-2022.” Gibson added. “We continue to see employers controlling hours worked as weekly earnings growth is below three percent again in April, indicating that while some workers are seeing increases in their hourly rate, they may not be taking more home.”

Jobs Index and Wage Data Highlights:

- At 100.12, the national jobs index continues to represent positive job gains but is down 1.06 percentage points from last year (101.18).

- Hourly earnings growth increased to 3.34% in April, marking the end of a steady deceleration that began mid-2022. However, as weekly hours worked growth (-0.41%) remains negative year-over-year, weekly earnings growth is below three percent again in April (2.88%).

- The West (3.75%) leads regional hourly earnings growth for the 11th consecutive month. Washington (4.91%) and Seattle (5.11%) tops states and metros, respectively, for hourly earnings growth among U.S. small business workers.

- The rate of small business job growth decelerated across all industries in April, though Education and Health Services (101.60) remains one of the strongest sectors for job growth.

- For the sixth consecutive month, Construction led growth among sectors in hourly earnings (3.85%), weekly earnings (3.80%), and weekly hours worked (0.28%).

The complete Small Business Employment Watch results for April 2024, including interactive charts detailing the data at a national, regional, state, metro, and industry sector level are available at www.paychex.com/watch. Learn more and sign up to receive monthly Employment Watch alerts.

About the Paychex Small Business Employment Watch

The Paychex Small Business Employment Watch is released each month by Paychex, Inc. Focused exclusively on businesses with less than 50 workers, the monthly report offers analysis of national employment and wage trends, as well as examines regional, state, metro, and industry sector activity. Drawing from the payroll data of approximately 350,000 Paychex clients, this powerful industry benchmark delivers real-time insights into the small business trends driving the U.S. economy. The jobs index is scaled to 100, which represents no year-over-year change in job growth among same store businesses. Index values above 100 represent new jobs being added, while values below 100 represent jobs being lost.

About Paychex

Paychex, Inc. (Nasdaq: PAYX) is an industry-leading HCM company delivering a full suite of technology and advisory services in human resources, employee benefit solutions, insurance, and payroll. The company serves approximately 740,000 customers in the U.S. and Europe and pays one out of every 12 American private sector employees. The more than 16,000 people at Paychex are committed to helping businesses succeed and building thriving communities where they work and live. Visit paychex.com to learn more.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240430349010/en/

Contacts

Tracy Volkmann

Paychex, Inc.

Manager, Public Relations

(585) 387-6705

tvolkman@paychex.com

@Paychex

Colleen Bennis

Matter Communications

Account Director

(585) 666-9510

cbennis@matternow.com