- At least 80% of institutional investors in all regions except Asia say their economies are or will be in a recession next year

- Most think inflation will remain high and that central bank policy alone can’t fix it. Nearly half believe an engineered soft landing is unrealistic

- Rising rates make bonds attractive again, but liquidity concerns are brewing

- Institutions disagree on outlook for stocks, are bullish on private equity, bearish on real estate, and double down on environmental, social and governance (ESG) investments, with big uptick in green bonds

- Emerging market outlook is caught up in geopolitical tug of war between the US and China, currency fluctuations and diminishing investment opportunities under a sharper ESG investing lens

Institutional investors enter 2023 with a somber view of the economy and mixed outlook for the markets on expectations of even higher interest rates, inflation and volatility, according to new survey findings published today by Natixis Investment Managers (Natixis IM). The vast majority (85%) believe the economy is or will be in a recession next year, which 54% think is necessary to get inflation under control. However, most (65%) institutions think the bigger risk ahead is stagflation, or a period of negative GDP growth with entrenched inflation and spiralling unemployment. Given the stakes, institutions believe a central bank policy error is one of the biggest threats to the economy, second only to war.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20221207005092/en/

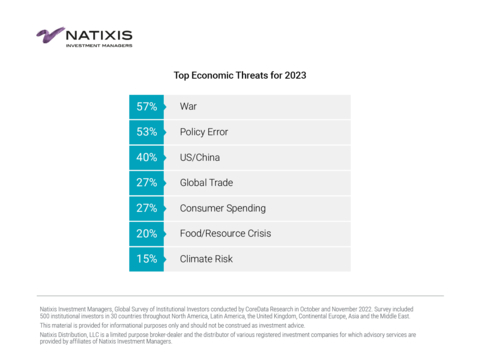

Top Economic Threats in 2023 (Graphic: Business Wire)

Natixis IM surveyed 500 institutional investors who collectively manage $20.1 trillion in assets for public and private pensions, insurers, foundations, endowments and sovereign wealth funds around the world.

The survey found that 53% of the world’s largest, most sophisticated investors are actively de-risking their portfolios with tactical allocation moves that reveal a flight to quality in fixed income and resourceful use of alternative strategies for higher yields, stable returns and a hedge against downside risks.

“Even though many institutional investors say a recession is inevitable, they still see opportunities in the market, especially in fixed income,” said Liana Magner, Executive Vice President and Head of Retirement and Institutional for Natixis IM in the US. “However, it’s no surprise that with top risks that include war, inflation, interest rates and monetary policy errors, 74% of institutions believe the markets will favor active managers in 2023, especially since the majority say their active investments have outperformed in 2022.”

On institutional investors’ forecast for the economy, the survey found:

- 54% expect ongoing rate hikes next year, including 70% in both Latin America and the UK and 59% in the US.

- 73% don’t believe monetary policy alone can curb inflation, and 54% predict inflation will remain the same or move even higher despite rate hikes.

- With the exception of Asia, where 34% of institutions don’t anticipate a recession, the vast majority of respondents in all other regions say their economies are or will be in a recession next year, including 100% of those in the UK, 86% in the US and EMEA, and 80% in Latin America.

Overall, institutional investors see inflation and interest rates as the two top risks to their portfolios. Liquidity also is bubbling up as an issue as central banks continue phasing out their asset purchase programs. The number of institutional investors who cite liquidity as one of the biggest risks to their portfolios has nearly tripled to 36% from 13% a year ago.

A number of other economic factors that are beyond the control of central banks are also weighing on their minds:

- Whereas supply chain disruptions ranked as institutional investors’ top economic threat heading into 2022, war now ranks as the biggest threat to the economy (57%), a sentiment that’s strongest in Europe (68%).

- 40% cite deteriorating relations between the US and China as a top economic threat, including 47% in Asia and 53% in the US after the mid-term elections, up from 25% before the election.

- 65% believe that China’s geopolitical ambitions eventually will lead to a bifurcation of the global economy into a two-world order, with China and the US representing the biggest spheres of influence. As such global trade concerns continue to be a top economic threat for 27% of respondents. Most (77%) think that ongoing supply chain disruptions will hinder economic growth; however, 62% believe that shifting supply chains from global to domestic and “friendly” markets also will slow growth.

2023 Market Outlook: Bonds are Back; Crypto is Out; More Volatility Ahead

Institutional investors’ consensus view on the markets for next year are:

- They are most bullish on private equity (63%) and are split between bulls and bears on their outlook for stocks and private debt.

- 72% think rising rates will usher in a resurgence of traditional fixed income, and their outlook on the bond market next year is mostly bullish (56%).

- 60% think large-cap stocks will outperform small caps, and outperformance will most likely come from the Healthcare, Energy, and Financial sectors.

- 61% agree that the ongoing prevalence of remote work will result in a sharp depreciation of commercial real estate assets; however, they remain committed to real estate and are investing in non-traditional or thematic-driven spaces, especially data centers and senior, student and affordable housing.

- 69% agree that valuations still do not reflect fundamentals, but 72% think the markets will finally come to terms next year with the realization that valuations matter.

- 57% expect stock volatility to rise while 64% expect bond volatility to settle down, the notable exception being in Asia where 46% expect increased volatility in bond prices. Half (50%) also see currency volatility rising.

- 62% expect developed markets to outperform emerging markets.

- 76% expect gold to outperform cryptocurrency. Moreover, 83% agree that blockchain technology is the real revolution anyway, not cryptocurrencies.

There is some disagreement among institutional investors on whether the dollar will strengthen (49%) or weaken (51%); however, 83% agree that the US dollar will maintain global dominance. The strength of the US dollar has important implications, particularly for emerging markets, which 64% of institutional investors agree are at the mercy of US monetary policy.

“Institutional investors are navigating the markets in an economy that has changed dramatically,” said Dave Goodsell, Executive Director of the Natixis IM Center for Investor Insight. “For three years now, world events have put the global economy on a rollercoaster ride, from the early stages of the pandemic to Russia’s war with Ukraine to the unwinding of expansionary monetary policy. What remains consistent are institutional investors’ long-term return assumptions, which is a testament to the rigor and innovation they bring to portfolio construction and the wide range of traditional, alternative and private asset tools they use to achieve their objectives.”

Portfolio moves: Tactical repositioning in a market calling for hyper-active management

The majority (67%) of institutional investors think that actively managed funds will outperform passive, and also that portfolios with a mix of stocks, bonds and alternative strategies will outperform those with a traditional 60/40 mix of traditional stocks and bonds. While they are planning to shift allocations by no more than 1% to or from any asset class, institutional investors are making notable tactical changes.

- Within equities, institutional investors are most likely to increase allocations to US stocks (40%) followed by Asia-Pacific (31%) and emerging markets (32%) stocks.

- Within fixed income and in an apparent flight to quality, nearly half (48%) are increasing allocations to government bonds and 49% plan to increase allocations to investment grade bonds. 63% say they will look to short-term bond ETFs to counter duration risk.

- In emerging markets, they see the best growth opportunities in Asia ex-China. Two-thirds (66%) agree that emerging markets are overly dependent on China, and 74% think China’s geopolitical ambitions have reduced its investment appeal.

- Within alternatives, institutions are most likely to increase allocations to private equity (43%), where they see energy, information technology and infrastructure investments as most attractive.

- 62% believe there is alpha to be found in ESG investments, and 59% plan to increase their ESG allocations. Fully half (50%) plan to increase allocations to green bonds, including 68% in Asia, 54% in EMEA and 51% in the UK, but only 16% in the US.

A full copy of the report on the Natixis Investment Managers Institutional Investor 2023 Market Outlook can be found here: https://www.im.natixis.com/us/research/institutional-investor-survey-2023-outlook

Methodology

Natixis Investment Managers Global Survey of Institutional Investors conducted by CoreData Research in October and November 2022. Survey included 500 institutional investors in 29 countries throughout North America, Latin America, the United Kingdom, Continental Europe, Asia and the Middle East.

About Natixis Investment Managers

Natixis Investment Managers’ multi-affiliate approach connects clients to the independent thinking and focused expertise of more than 20 active managers. Ranked among the world’s largest asset managers1 with more than $1 trillion assets under management2 (€1 trillion), Natixis Investment Managers delivers a diverse range of solutions across asset classes, styles, and vehicles, including innovative environmental, social, and governance (ESG) strategies and products dedicated to advancing sustainable finance. The firm partners with clients in order to understand their unique needs and provide insights and investment solutions tailored to their long-term goals.

Headquartered in Paris and Boston, Natixis Investment Managers is part of the Global Financial Services division of Groupe BPCE, the second-largest banking group in France through the Banque Populaire and Caisse d’Epargne retail networks. Natixis Investment Managers’ affiliated investment management firms include AEW; AlphaSimplex Group; DNCA Investments;3 Dorval Asset Management; Flexstone Partners; Gateway Investment Advisers; Harris Associates; Investors Mutual Limited; Loomis, Sayles & Company; Mirova; MV Credit; Naxicap Partners; Ossiam; Ostrum Asset Management; Seeyond; Seventure Partners; Thematics Asset Management; Vauban Infrastructure Partners; Vaughan Nelson Investment Management; and WCM Investment Management. Additionally, investment solutions are offered through Natixis Investment Managers Solutions and Natixis Advisors, LLC. Not all offerings are available in all jurisdictions. For additional information, please visit Natixis Investment Managers’ website at im.natixis.com | LinkedIn: linkedin.com/company/natixis-investment-managers.

Natixis Investment Managers’ distribution and service groups include Natixis Distribution, LLC, a limited purpose broker-dealer and the distributor of various U.S. registered investment companies for which advisory services are provided by affiliated firms of Natixis Investment Managers, Natixis Investment Managers S.A. (Luxembourg), Natixis Investment Managers International (France), and their affiliated distribution and service entities in Europe and Asia.

1 Cerulli Quantitative Update: Global Markets 2022 ranked Natixis Investment Managers as the 18th largest asset manager in the world based on assets under management as of December 31, 2021.

2 Assets under management (“AUM”) of current affiliated entities measured as of September 30, 2022 are $1,072.9 billion (€1,095.4 billion). AUM, as reported, may include notional assets, assets serviced, gross assets, assets of minority-owned affiliated entities and other types of non-regulatory AUM managed or serviced by firms affiliated with Natixis Investment Managers.

3 A brand of DNCA Finance.

5281113.2.1

View source version on businesswire.com: https://www.businesswire.com/news/home/20221207005092/en/

Contacts

Kelly Cameron

+ 1 617-449-2543

Kelly.Cameron@natixis.com